““Men who can both be right and sit tight are uncommon.””

In the previous post we discussed the first known bubble (Tulipomania). In this post we will assess other more tangible examples that should help you forget the notion of "Now or never" with stocks you want to purchase.

BUBBLICIOUS

We've all at one point or another tried to blow the biggest bubble we can. We dance that fine line of trying to get it as big as we can without it snapping gum back in our face. The analogy of a bubble is quote symbolic, and in turn, quite perfect. When you're first blowing a bubble it takes quite a bit more effort than it does to actually pop it at the end. That said, there is also an inflection point where it doesn't take much effort to actually make the bubble get bigger. Physics takes over and the volume inside the bubble is optimal for growing it. That is of course until it's not.

If you recall from the previous installment we talked about the first known bubble, Tulip mania (or Tulipomania). Since it's hard to grasp relative to today's terms let's use stocks and indexes to illustrate what a bubble looks like and what happens when the gum snaps.

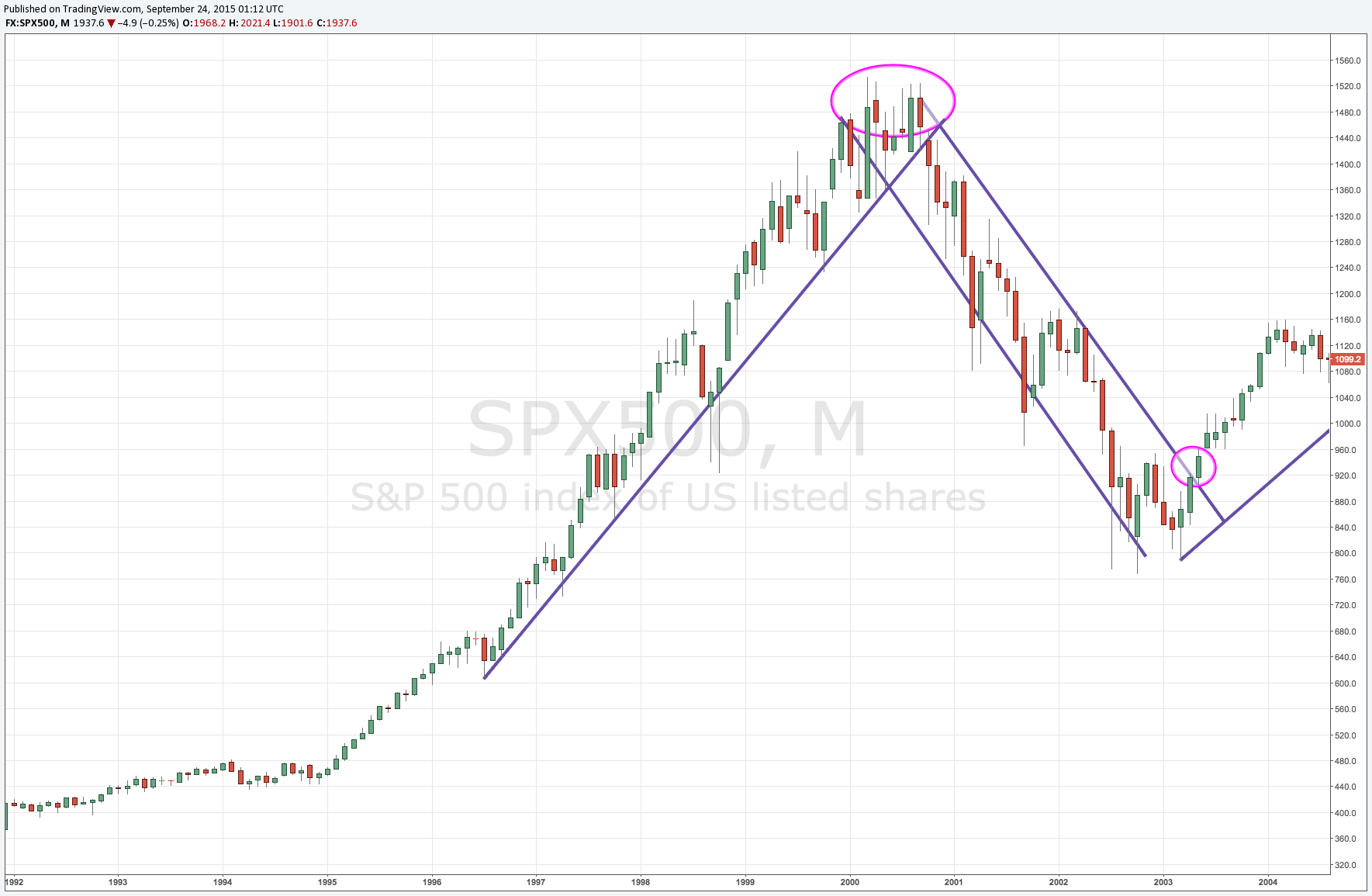

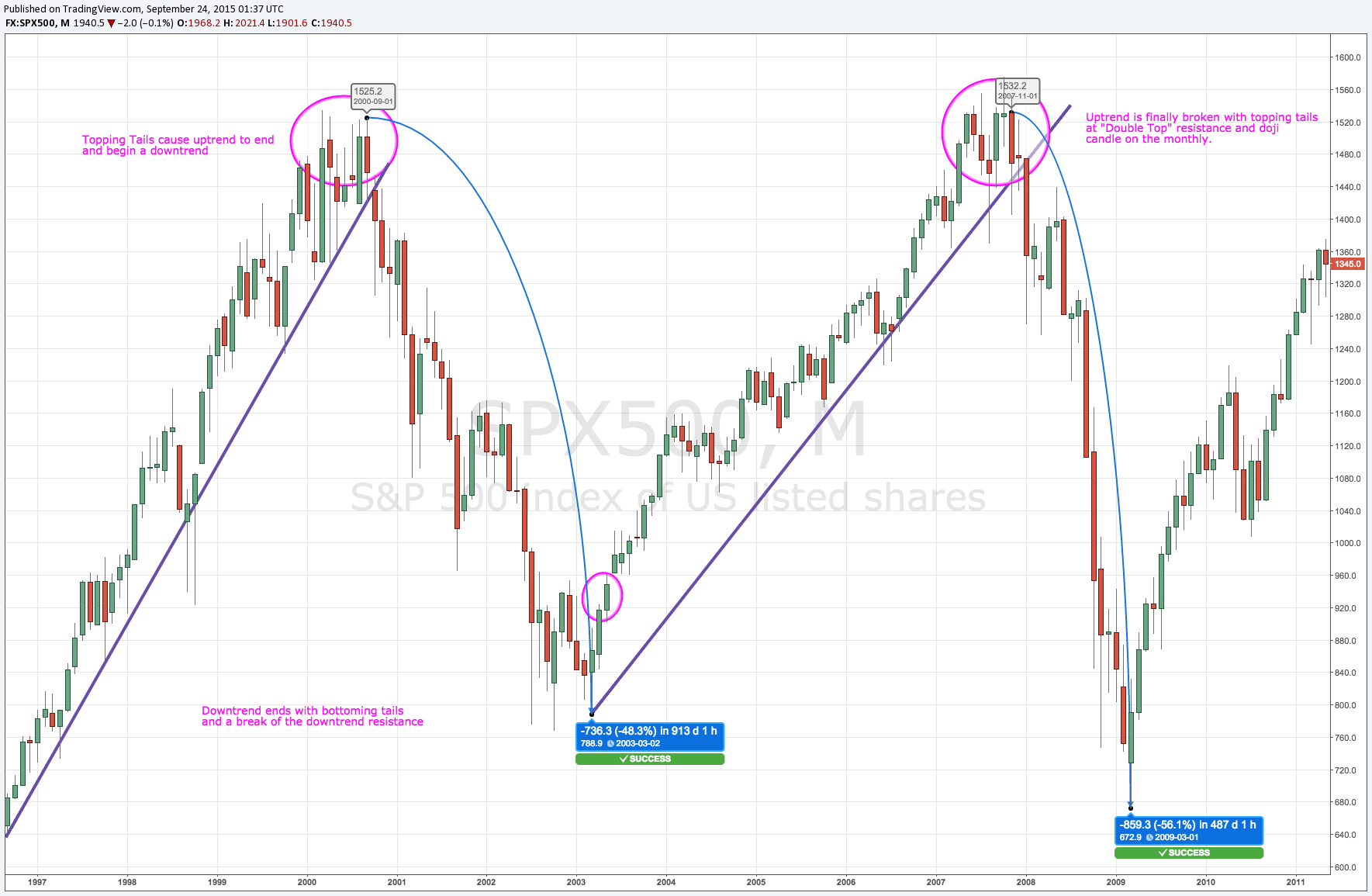

.COM (1995 - 2001)

Sure many of you have heard of the .com boom/bust but how many of you have actually taken the time to investigate just how big it really was? Fear not, we'll take a look at some of what went down during that era.

The point to take away from the above is not that there is any prediction about a foredooming situation in the markets. The point is that when markets start to break the accelerant behavior of the market selloff is vastly greater than the rising behavior in an uptrend.

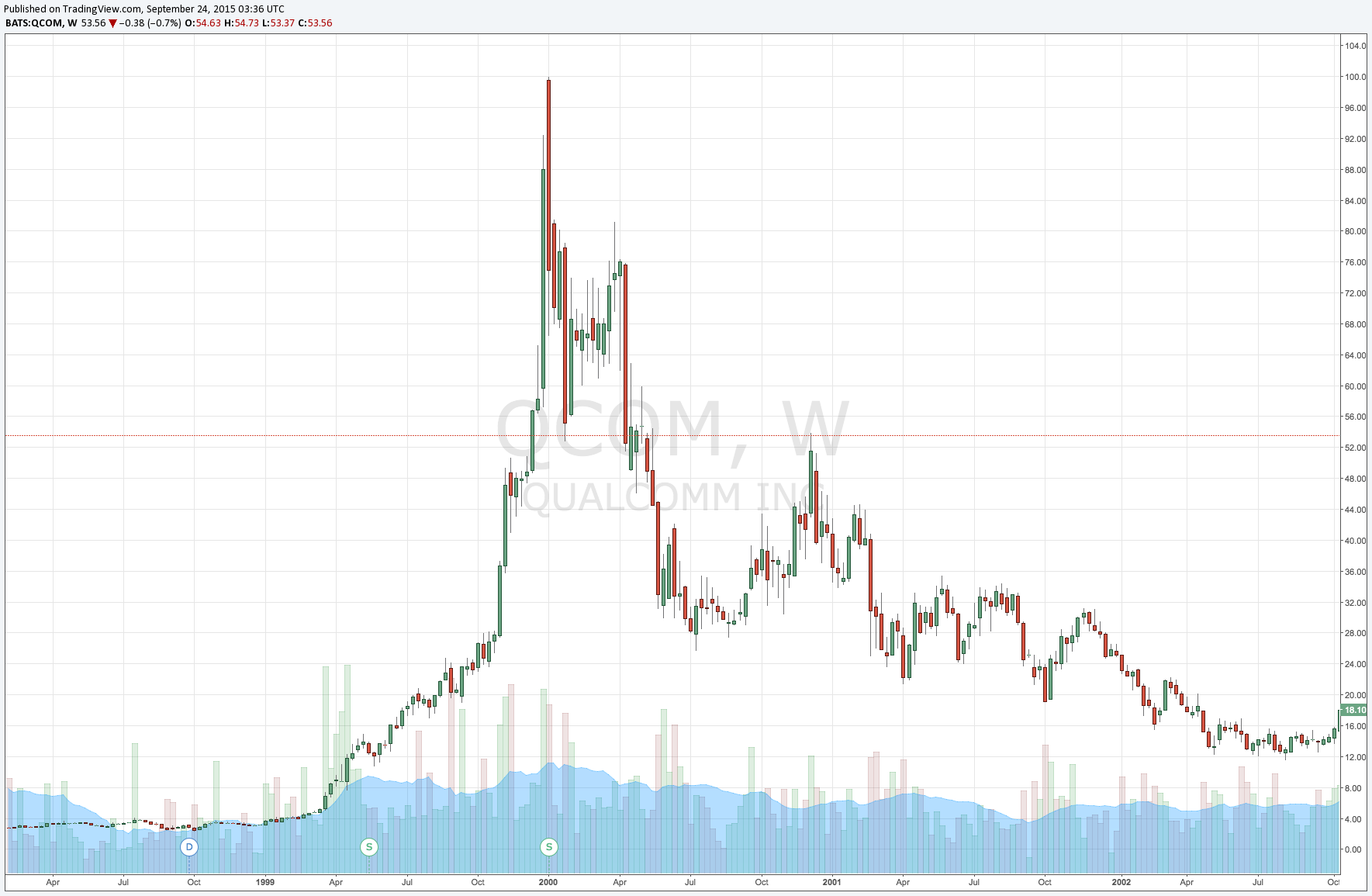

Let's take a look at some individual names from the .com bubble. Most of these companies still exist today.

Some of these companies eventually recovered (AMZN AAPL) but most do not and never do.

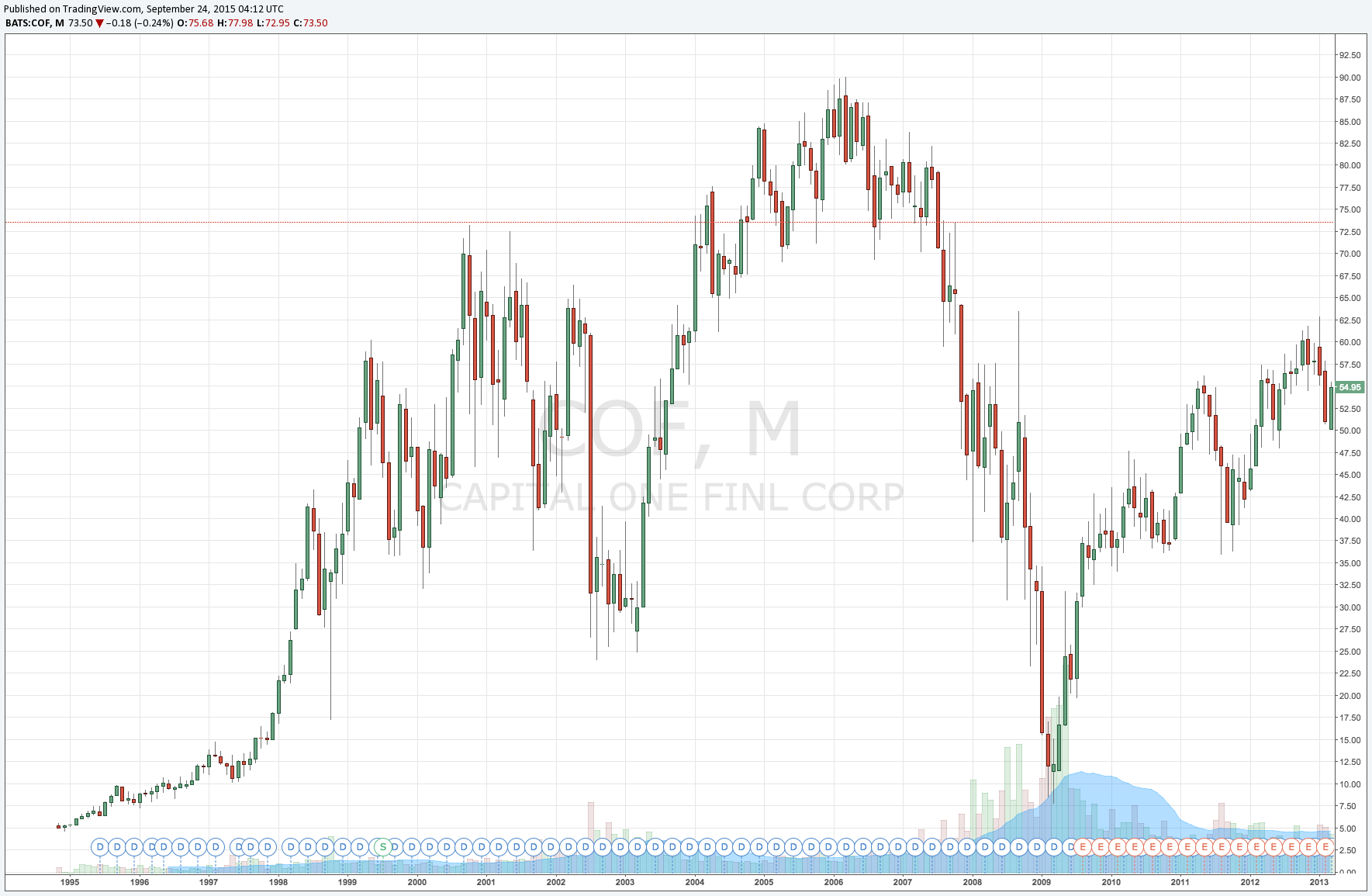

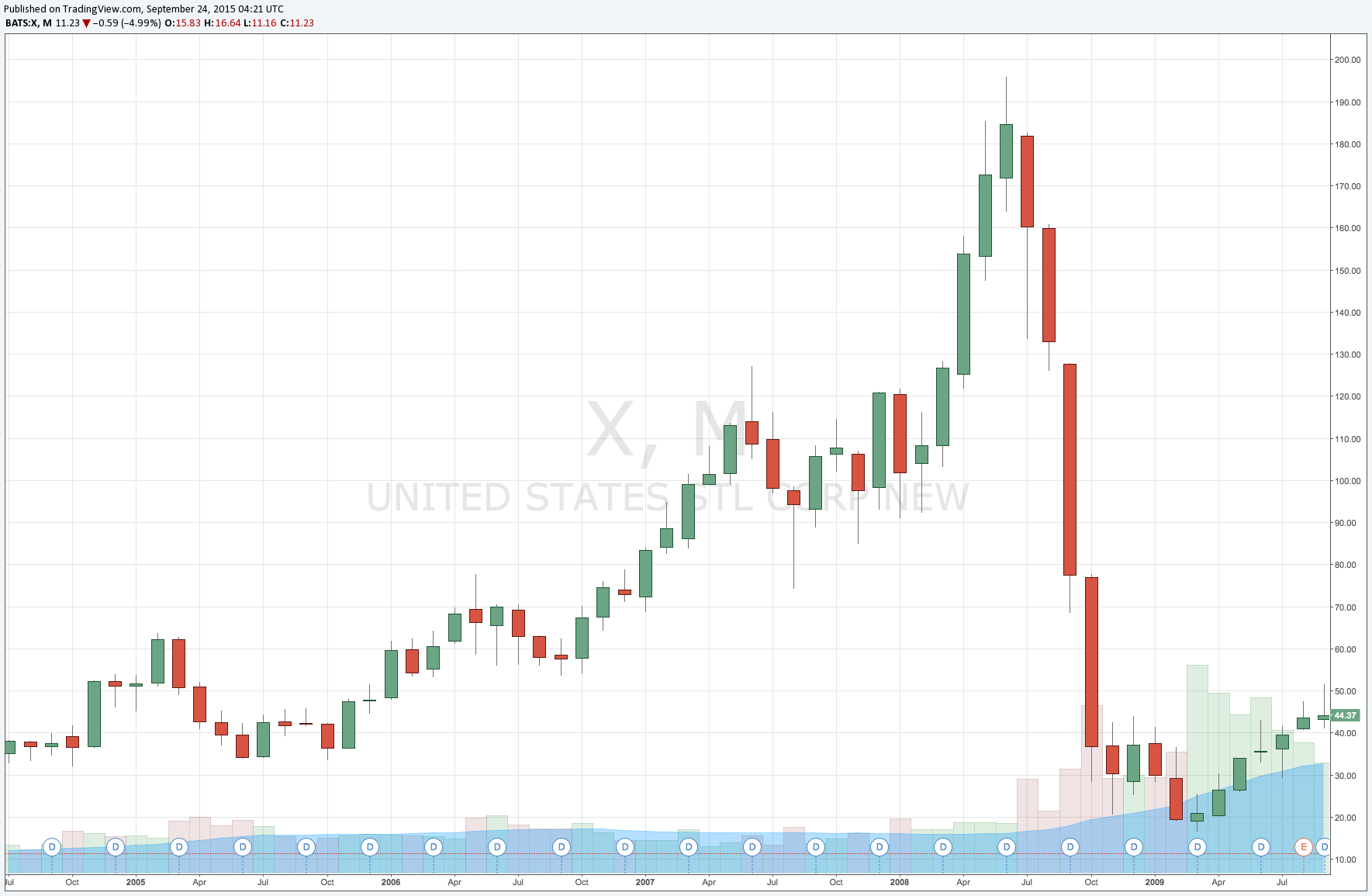

HOUSING SUB PRIME

Soon after the dot com bubble dust settled we were in the middle of yet another cataclysmic bubble, the housing bubble. In many cases this was significantly worse than the dot com bubble because it impacted many sectors across the board and scarred many investors for years to come. Some of the stocks that were resilient through the .com collapse (namely banks) were absolutely obliterated after the housing crisis. Unlike tech stocks that were a “new paradigm” the housing market was built on the notion that “everyone needed a home” and that homes and investment property in general functioned as a “store of value” which was infinitely “safer” than the bogus paper of the .com stocks. Just like tech stocks however, these stocks and this sector was overplayed by the greed of the investors and facilitated catastrophe in the end.

Take a look at just how big some of these decays where.

As you can see, most of these names still have not recovered from that beatdown they suffered

POP

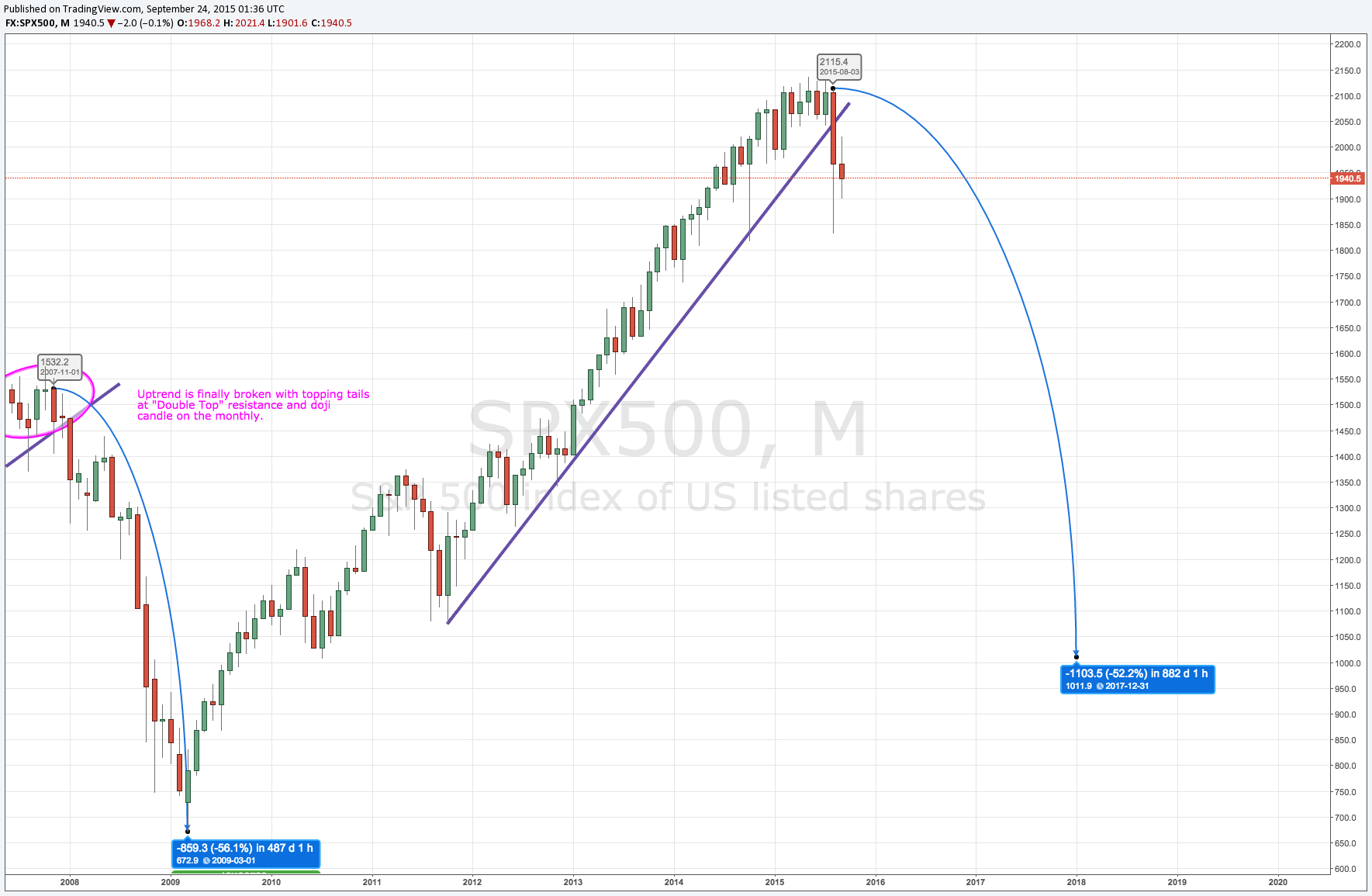

So what did we learn? We learned that typically when markets take off things get vertical pretty quickly and they last for multiple years. We also learned that when they break, they fucking break. The breach of trend is typically at least a 50% correction and that correction is much more violent than the uptrend. If the market leader turns out to be the cause of the bubble, that break is typically significantly more than the 50% correction and usually 80% or more is lost.

That said, we need to remember our rules. We need to stay disciplined when things break trend and learn to get out when our stops are blown. Even though we don't need anymore reminders, let's conclude by going over the basic flow of a bubble.

I’d like to end this by simply reminding you that this is not a forecast of doom and gloom to come. This is just an explanation to you that history has a funny way of repeating itself over and over again. Whether it’s tulips, railroads, tech stocks, housing or maybe the future cure for AIDS, investors have always and will always overplay their hands causing the majority to be left with the pain in the process.

With that said, the investment vehicles that are left standing at the end of the day have always, and without exception, fucking lasted through capitulation.

Let the games begin.