As expected, last week showed us a range bound week (inside week) following a 12% run up in the SPY. Action was quite volatile relative to the last few weeks with a couple of false breakouts and breakdowns.

SPY

The SPY was range bound last week with 20 and 200MA functioning as support. As highlighted last week the 2030 level has functioned as support for the SPX and 2070 has been resistance. After last week's inside week we're going to pause for a break to the upside above 2070 or a breakdown below 2025. My bias is that a new wave of leadership is forming in the markets and that this rally in gold can propel for a while longer. That said, the SPX/SPY is in a downtrend since May of 2015 with lower highs. We will in fact see as earnings season kicks into high gear and the banks start to report.

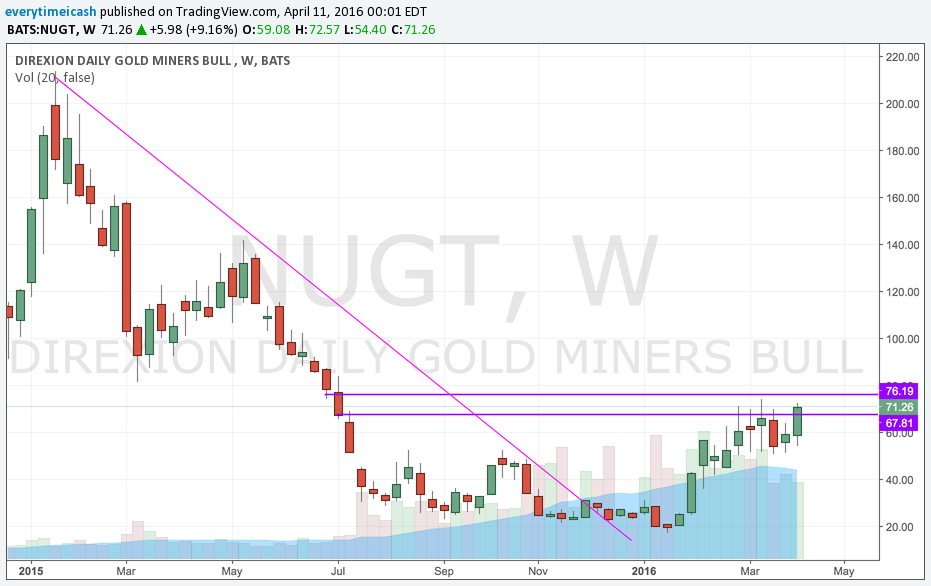

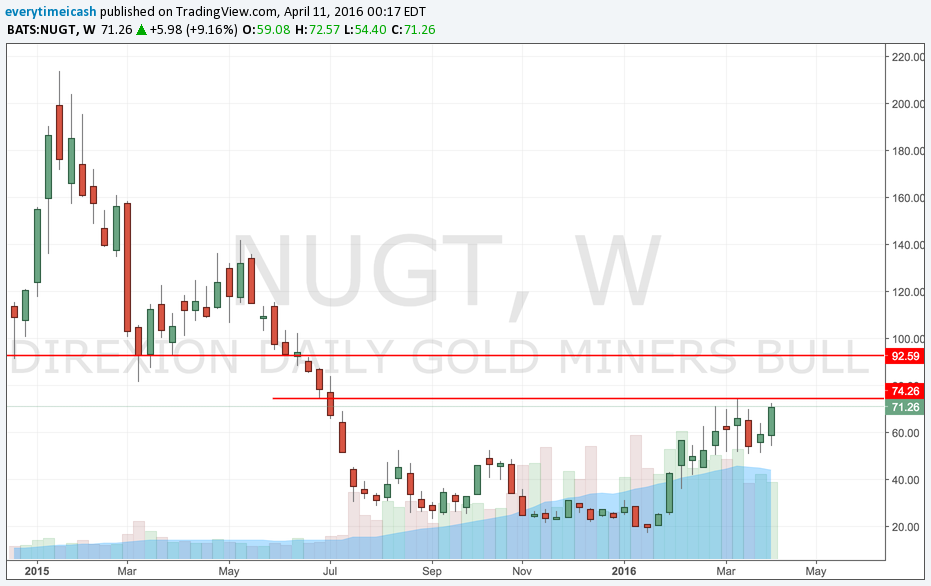

GLD GDX NUGT

As seen recently, gold has begun to break out as it broke its downtrend with a higher high and channel break. After a period of consolidation, it is apparent gold is ready to make its run again. As gold goes, so do its derivatives

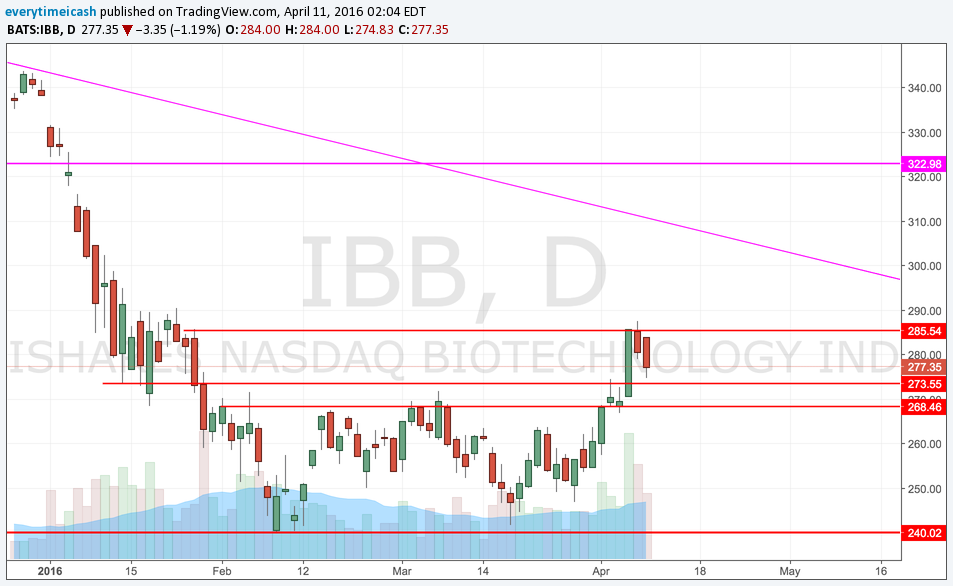

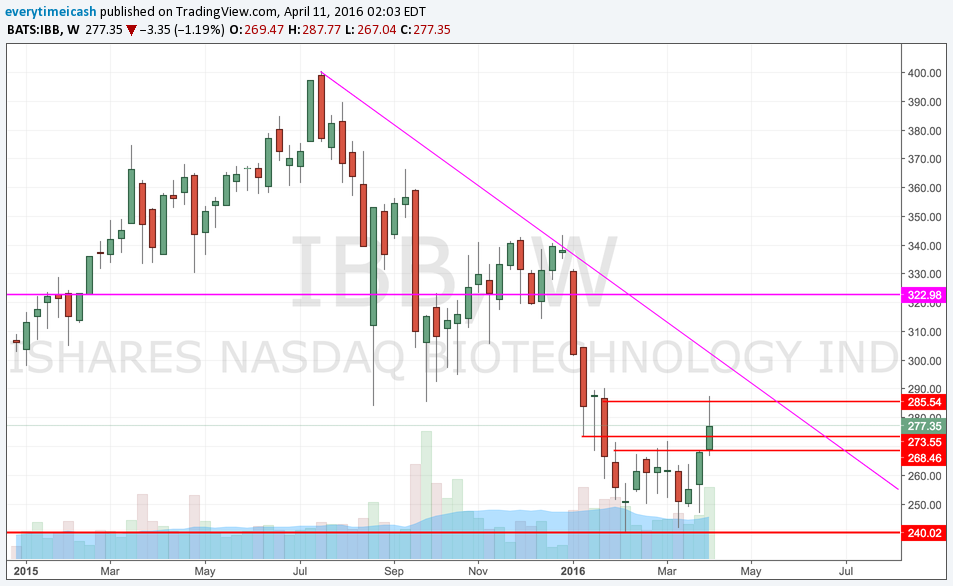

IBB

As noted two weeks ago, the IBB bounced of its 50% retrace from the highs and has continued the run since. Our target of 285 was reached and we're now waiting for some consolidation before a potential run higher. A potential retrace to the downtrend is what we're potentially looking for.

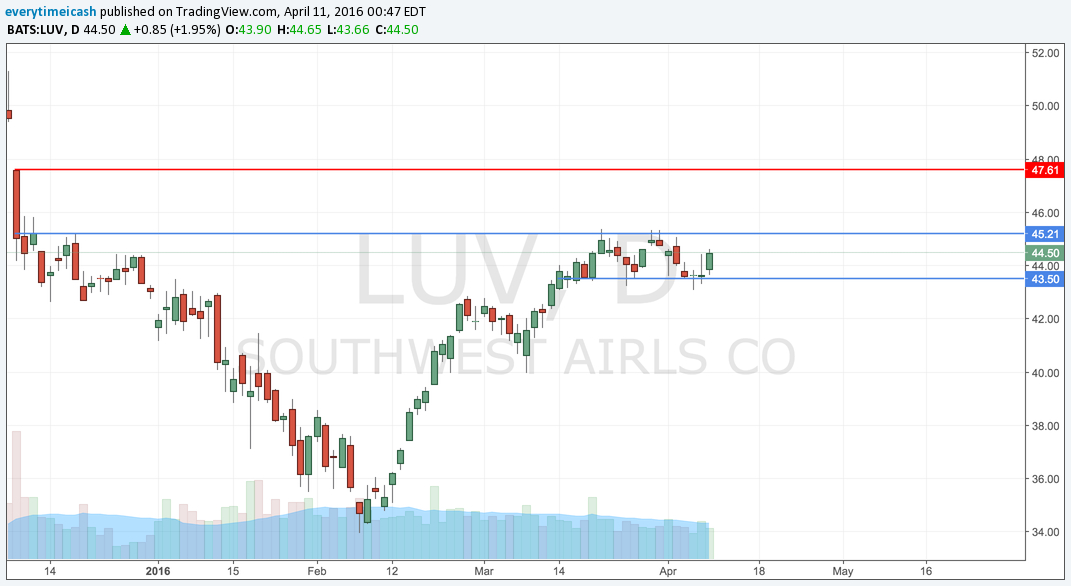

LUV

Aggressive call buying into consolidation and this one is set to take off higher.

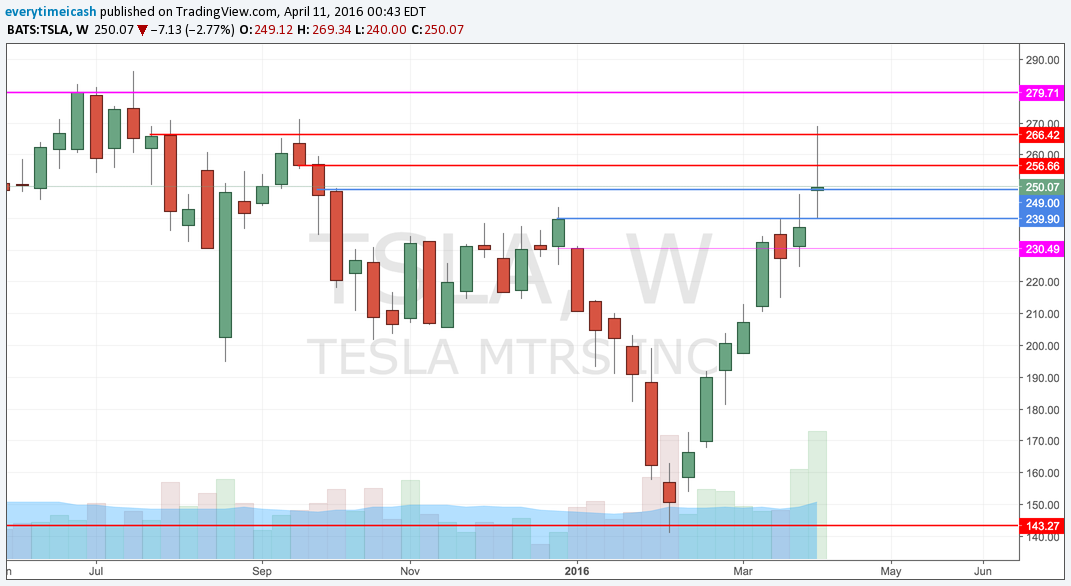

TSLA

After a torrid run up almost doubling its share price in approximately six weeks, TSLA finally hit resistance and started to turn lower.

AMZN

After a face rip week, last week saw some consolidation. We're working with a flat 200MA and a breakout above 604 to spark this thing.

XRT

After leading us on the way up, XRT has started to roll over as it hit resistance into its previous up trend.

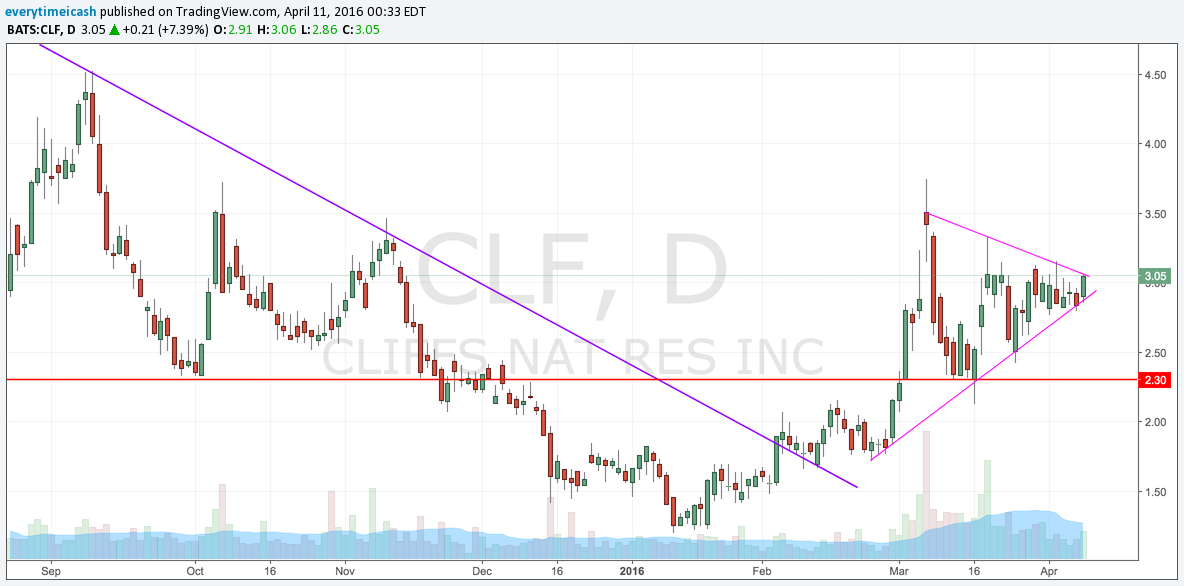

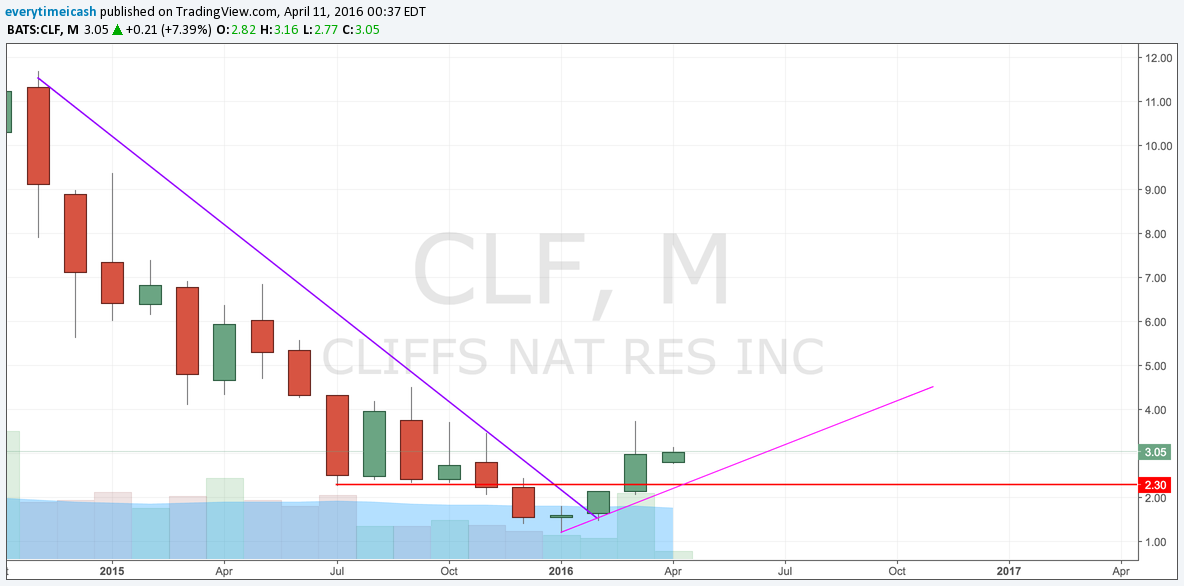

CLF FCX

Both in a flag and looking to break up or down. (Bias Up)

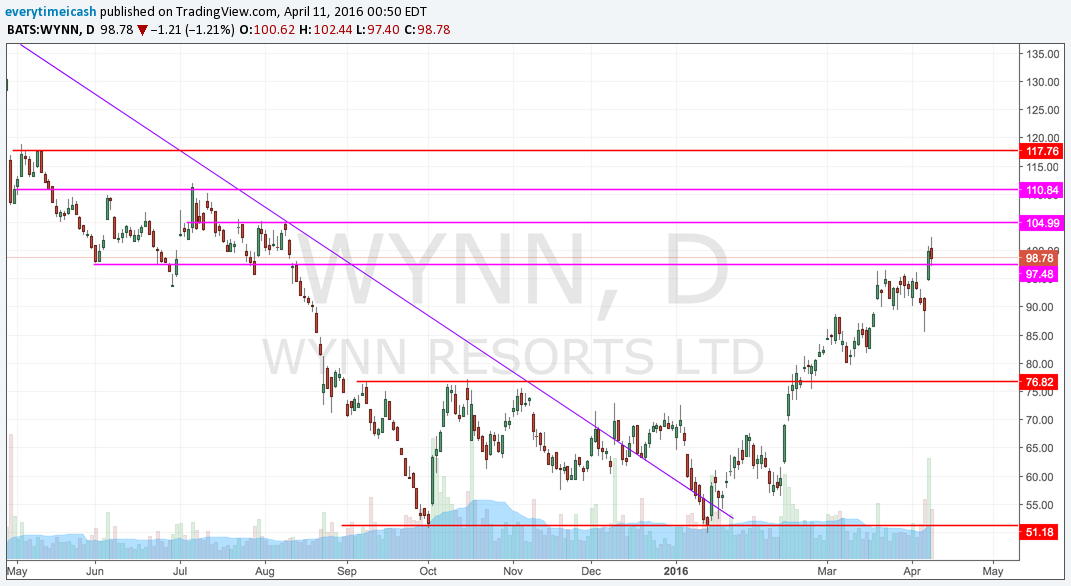

WYNN

Ignore the "Fast Money" stupidity by the guy who has a 17% stop. Stick with trend until it's broken. Currently 97.5 has functioned as support and below that is the box breakout support of 96. Last week we saw some continued May C buying by the wise guys.

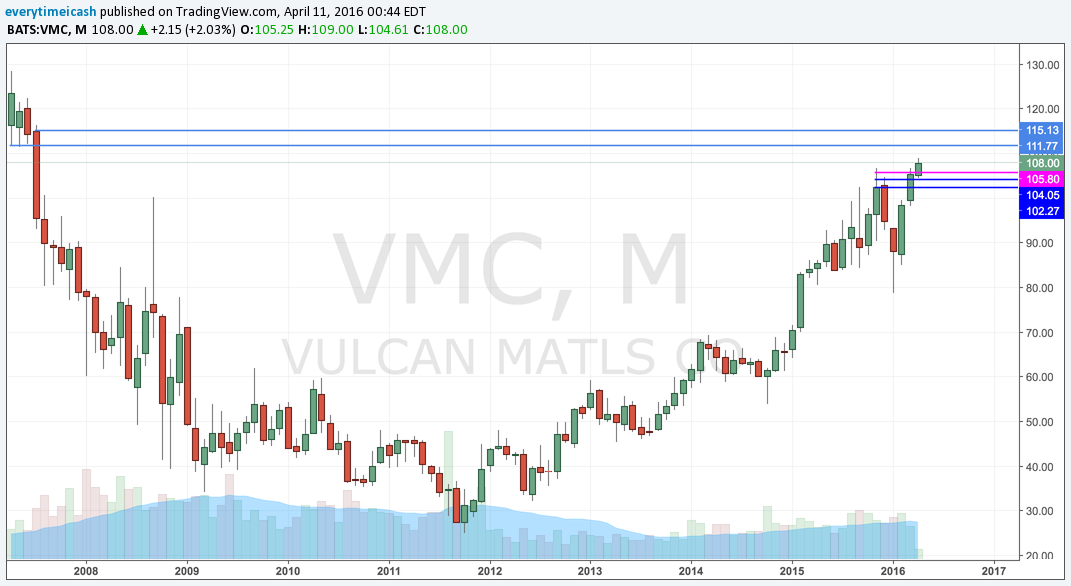

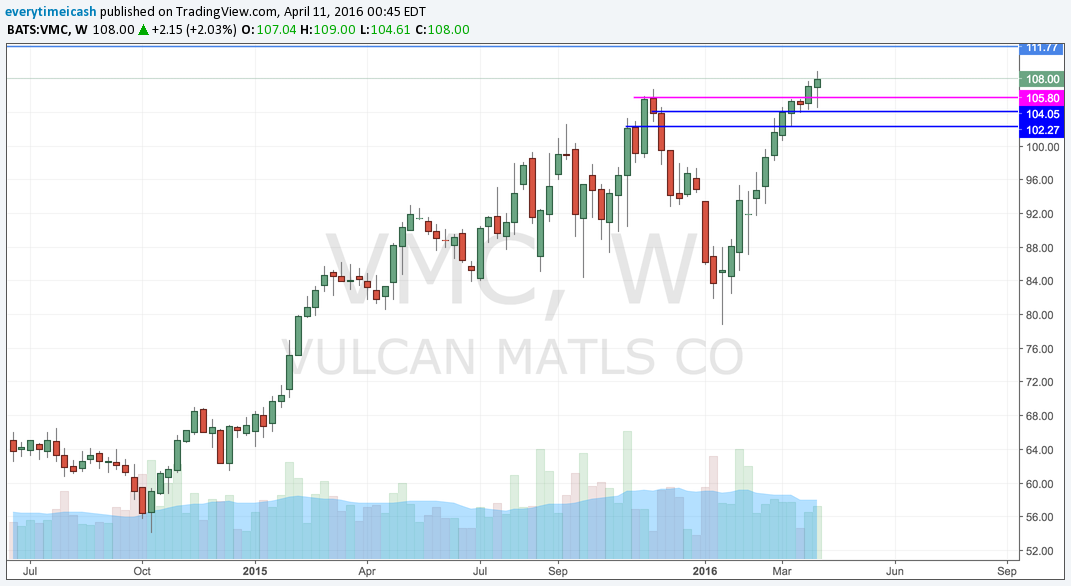

VMC

My favorite materials company out there. Period.

China

Some China names have recently caught a bid and my favorite setup at the moment is potentially BITA.

This is a former high flyer with recent accumulation volume.

XOP

This showed a break in 2014 and has been in a downtrend since. As of late however, it has showed some signs of stabilization in an attempt to get back to its down trend.

Basing for a potential break to the downtrend.