Goldman Sachs (GS) is set to report Q1 earnings tomorrow before the open with a conference call to follow at 9:30am ET. Consensus stands at EPS of $2.50 on Revenue of $6.523 bln.

Markets await the GS results as banks continue to show signs of a weak Q1 trading environment. GS has frequently posted strong bottom line beats and tomorrow's report is expected to show another outpacing of consensus.

It will be tough to do with expectations for an ~30% slide in its Q1 trading revenue. Anything above that will be bullish.

Q4 Recap

GS reported Q4 (Dec) earnings of $4.68 per share compared to the Consensus of $3.62; revenues fell 5.5% year/year to $7.27 bln vs the $7.04 bln Consensus.

- Annualized ROE as 3.0% for the fourth quarter of 2015.

Investment Banking

- Net revenues in Investment Banking were $1.55 billion for Q4, 7% higher y/y.

- Net revenues in Financial Advisory were $879 million, 27% higher y/y.

- Net revenues in Underwriting were $668 million, 11% lower y/y.

- Net revenues in Fixed Income, Currency and Commodities Client Execution were $1.12 billion for the fourth quarter of 2015, 8% lower y/y. Net revenues in Equities were $1.76 billion for the fourth quarter of 2015, 9% lower y/y.

Investing & Lending

- Net revenues in Investing & Lending were $1.30 billion for the fourth quarter of 2015, 15% lower y/y.

- Net revenues in Investment Management were $1.55 billion for the fourth quarter of 2015, essentially unchanged compared with the fourth quarter of 2014 and 9% higher than the third quarter of 2015.

Noncomp Expenses

- Non-compensation expenses were $4.14 billion for the fourth quarter of 2015, 64% higher y/y. T

- Net provisions for litigation and regulatory proceedings for the fourth quarter of 2015 were $1.95 billion compared with $161 million for the fourth quarter of 2014.

- Book value per common share was $171.03 and tangible book value per common share was $161.64, both 5% higher compared with the end of 2014 and essentially unchanged compared with the end of the third quarter of 2015.

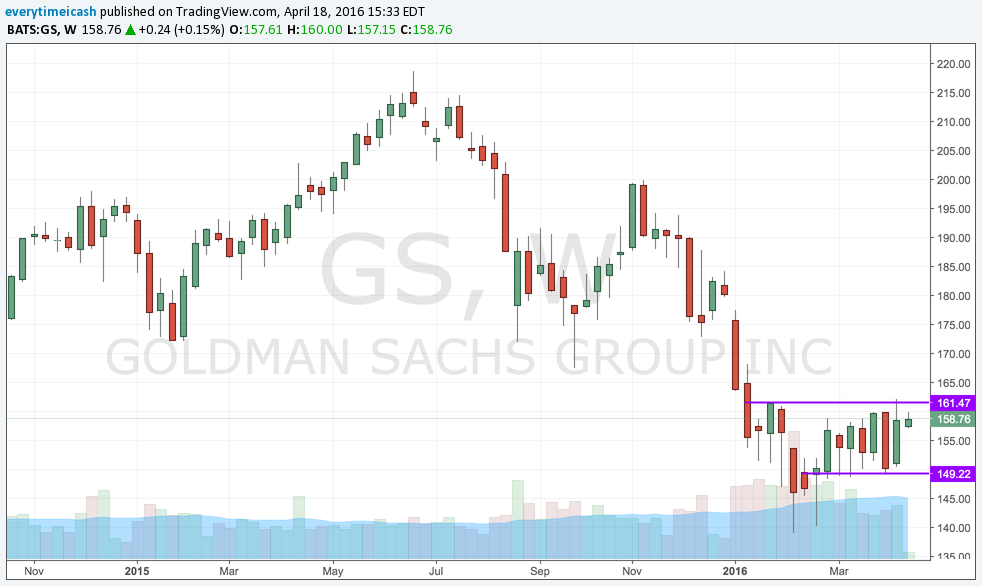

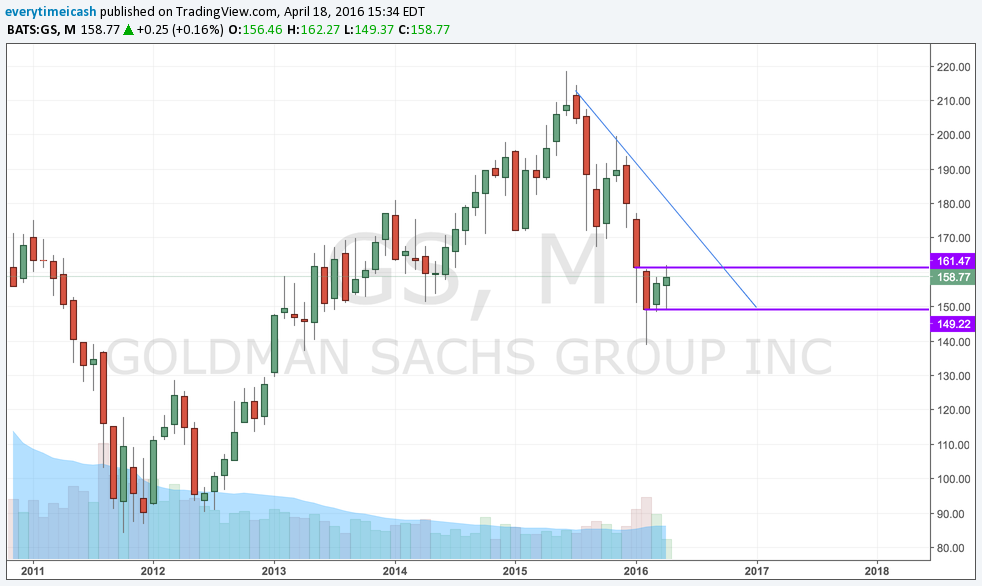

TECHS

Consolidating in a channel on the daily and weekly time frames. Still in a downtrend on the monthly but has room to test the downtrend.

20,230 options contracts traded with 60/40 in favor of calls. Implied volatility at 26.5% with a 4.2% move projected.