The market will be paying close attention to several reports from the banking industry on Friday morning. The two "most important" being Bank of America and JP Morgan.

Bank of America Fourth Quarter Earnings Report (Friday, January 13, before the market opens)

Importance:

- Bank of America is the second-largest U.S. bank in terms of assets.

- Bank of America derives close to 90% of its revenue from the U.S. and has a large consumer banking operation

- Bank of America has the weight, and influence, to be a market mover for better or worse.

- Shares of BAC have surged 34% since Election Day (November 8), riding a wave of pro-growth U.S. optimism like few stocks have.

- Expectations are high ahead of its report and a lot of good news has been priced in already. What the bank says, and how its stock reacts following the earnings report, will have a dictating force on other financial shares that have made a big post-election move.

3rd Quarter Report:

- Continues to target cutting expenses to $53 billion in 2018

- Consumer is growing faster than commercial, but expects commercial to come back once election cycles have past and economy continues to recover

- Average basis total loans in third quarter were up $22 billion, or 3% from Q3 2015, and while up from the second quarter, growth was at a slower pace

- Third quarter trading revenue was the highest it has been in five years

What To Watch:

- BAC

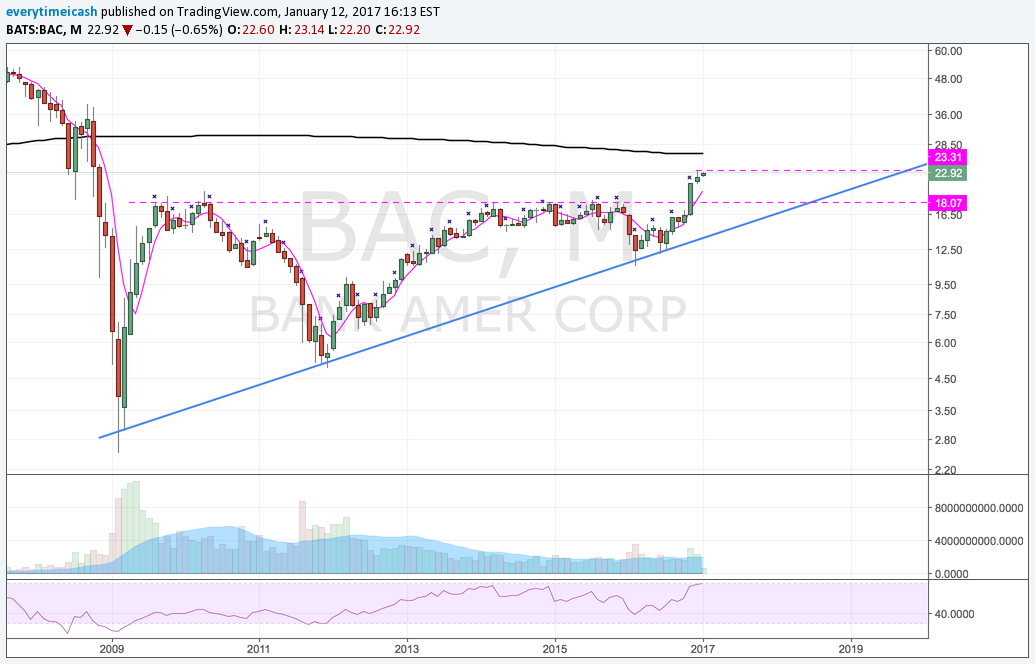

BAC Broke out of a large term range back in November after the election. It then went on to an unprecedented 34% rally and has spent the better part of a month consolidating in a tight bull flag. A breakout to the upside would yield further gains whereas any negative commentary could put the pause on any subsequent gains.

Related companies

- Citigroup (C)

- JPMorgan Chase (JPM)

- Wells Fargo (WFC)

- US Bank (USB)

- Goldman Sachs (GS)

- Morgan Stanley (MS)

Sector ETFs

- Financial Select Sector SPDR ETF (XLF)... BAC is fourth largest holding at 7.81% of assets

- iShares US Financials ETF (IYF)... BAC is fourth largest holding at 4.96% of assets

- Vanguard Financials ETF (VFH)... BAC is third largest holding at 6.37% of assets

- SPDR S&P Regional Banking ETF (KRE)

- SPDR S&P Bank ETF (KBE)