General Electric (GE) is set to report Q3 results tomorrow before the market opens with a conference call to follow at 8:30am ET.

Current Capital IQ consensus stands at EPS of $0.49 on Revenues of $32.51 bln.

John Flannery's first quarter with the company has been a rough one, at least in terms of share price. A Q2 narrow beat on the top line and $0.03 beat on bottom line adjusted EPS were not enough to support the valuation and shares finished the following session down about 5%.

The bearish case for this stock seems to be very strong. There has been speculation surrounding the possibility of a dividend cut, several top executives have recently decided to leave the company, and broker research firms have painted an overall gloomy picture.

Comparable Industrial Valuations/Dividends:

GE

- P/E of 26.5x; Adjusted EPS declined 45%

- Revenues declined 3.6%

- Div yield of 4.2% (there has been speculation pointing to a dividend cut); 1 yr growth of 4.4%

3M (MMM):

- P/E of 24.9; Adjusted EPS grew 24%

- Revenues grew 1.9%

- Div yield of 2.2%; 1 yr growth of 5.9%

Honeywell (HON)

- P/E of 22.2x; Adjusted EPS grew 8.4%

- Revenues grew 0.9%

- Div yield of 2.1%; 1 yr growth of 25.2%

United Technologies Corp (UTX):

- P/E of 18.3x; Adjusted EPS grew 1.6%

- Revenues grew 2.7%

- Div yield of 2.4%; 1 yr growth of ~6%

*All Div yields are annualized based on most recent dividend paid; growth rates based on annualized dividend y/y

*Rev and EPS growth/declines based on total revenues and adjusted EPS from 2Q17 vs. 2Q16, respectively.

Analysts:

- Tgt lowered to $23 from $27 at Goldman after revising EPS/FCF estimates and potential for dividend cut (10/17/2017)

- Tgt lowered to $20 from $22 at JP Morgan (10/11/2017)

- Tgt lowered to $21 from $24 at Deutsche Bank; maintain Sell (09/11/2017)

Options Market:

Based on GE options, the current implied volatility stands at ~ 28%, which is 26% higher than historical volatility (over the past 30 days). Based on the October GE $23.5 straddle, the options market is currently pricing in a move of ~4% in either direction by October expiration (Friday).

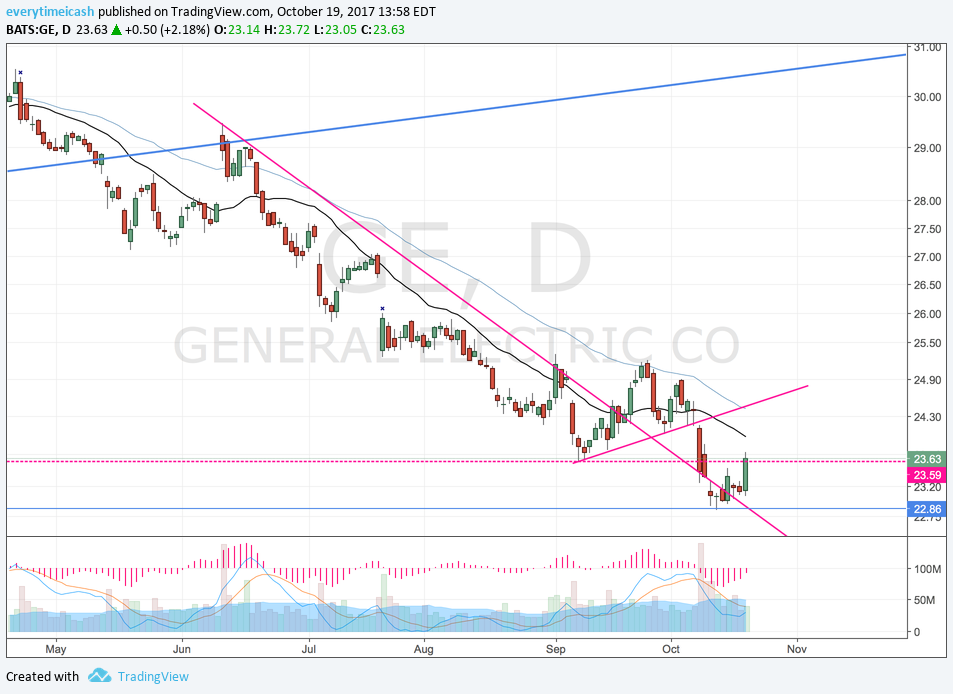

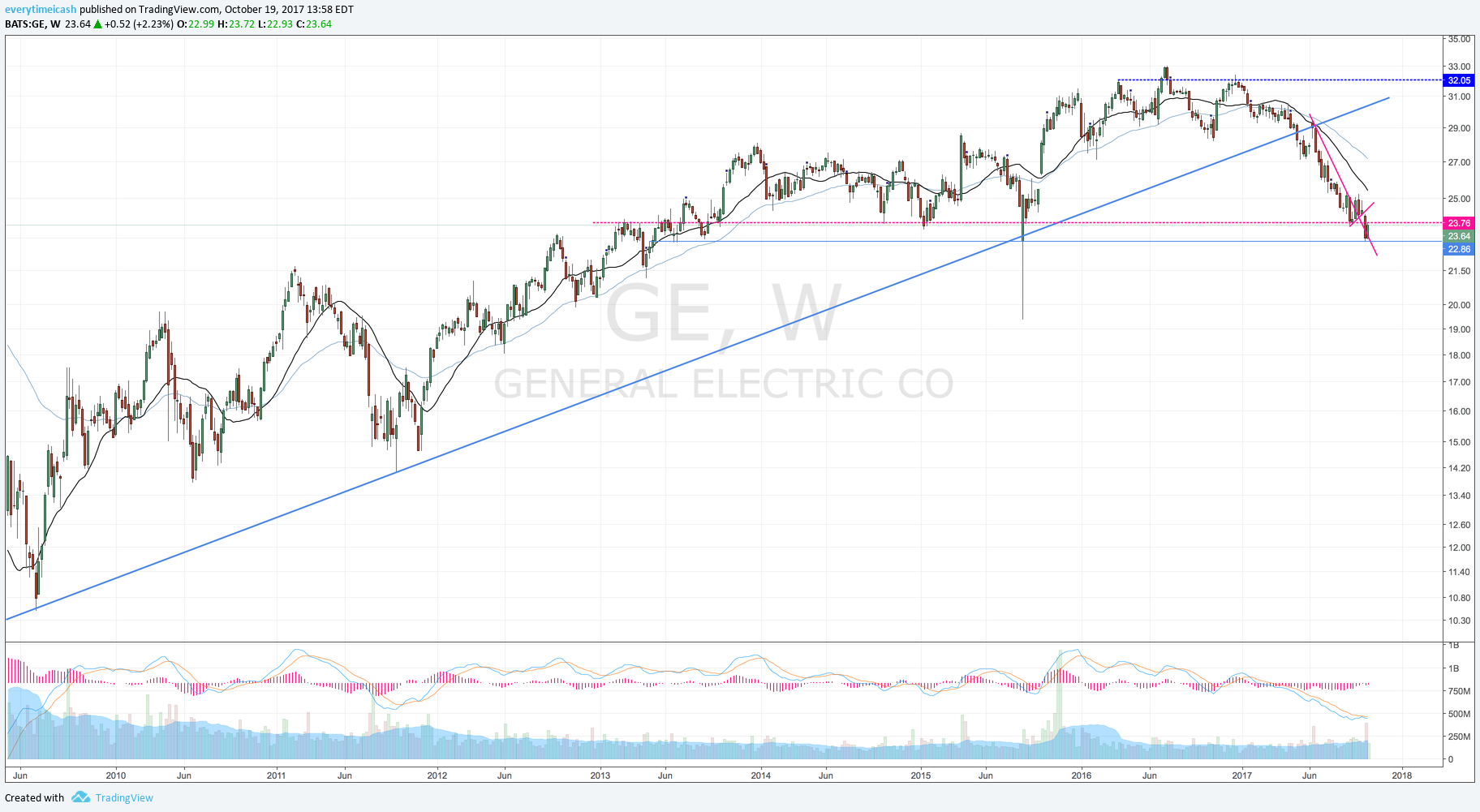

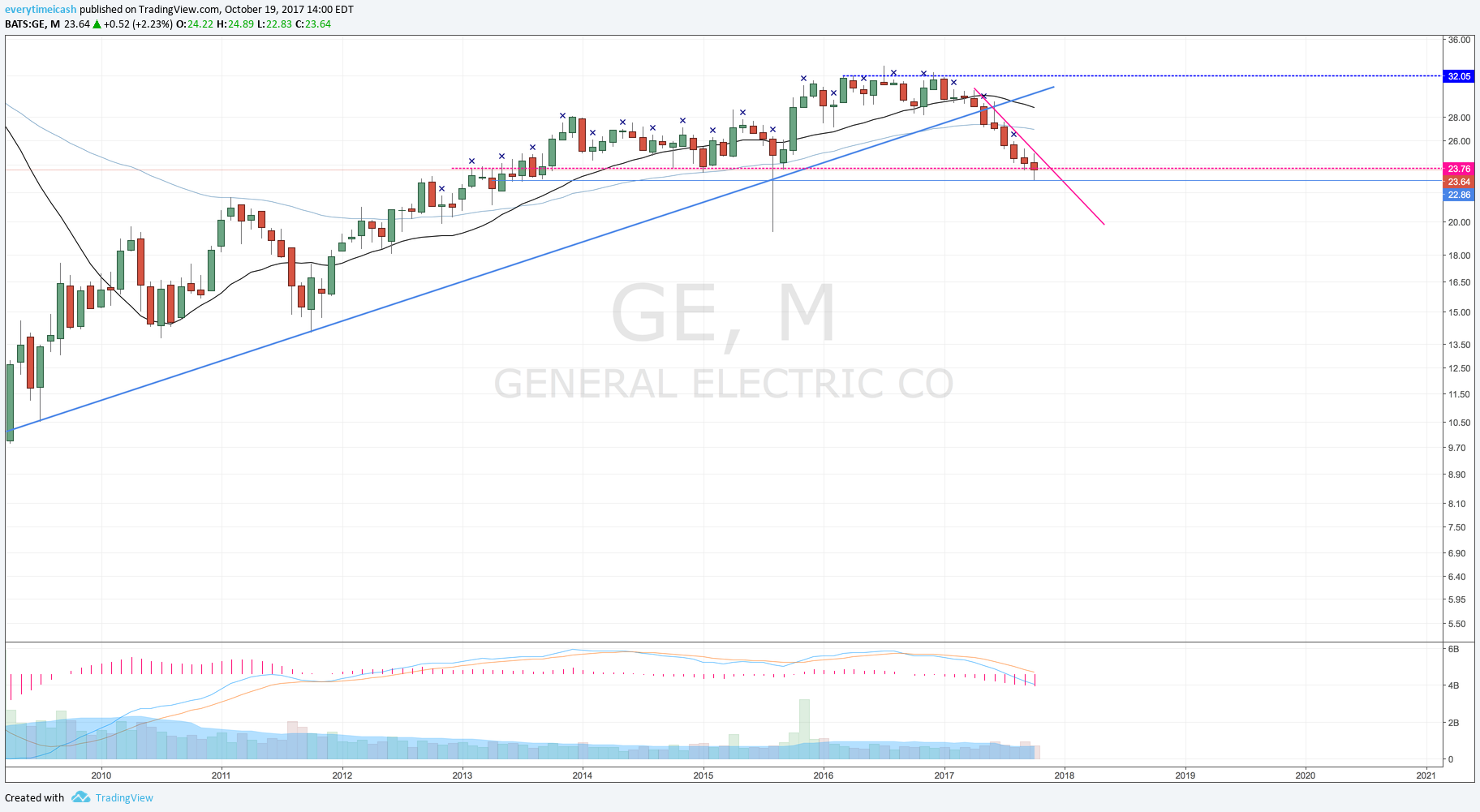

TECHS:

Technically, GE is among this years worst-performing stocks as it has been "trend down" for an approximate -28% loss. The burden of proof lies on Buyers to reverse this downtrend, starting with a lift back above its downsloping 50-day ma near the $24-vicinity.