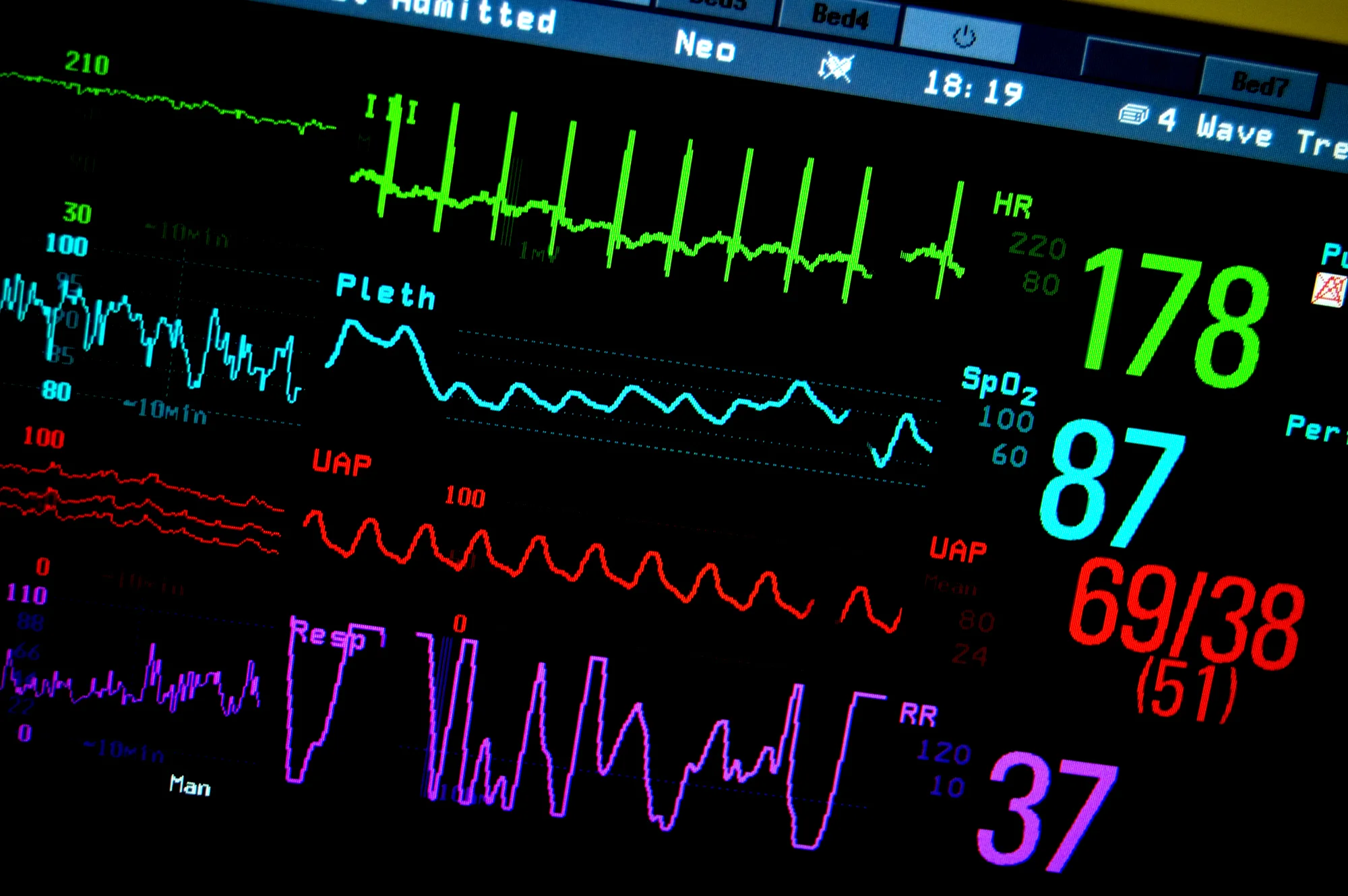

“Everything you need to know is right there in front of you.”

This morning was weird. The market felt heavy and tired. The bulls seemed exhausted and it appeared as though we'd get a late day fade such as the one we had yesterday. Earnings were missing left and right, market leaders were weighing on the market, everything "felt sluggish." I mean, even I called it this morning premarket. "$GS 175-176 support if it closes below that get ready to short it to hell."

Something strange happened this morning though, something different. This was the first time in a while that the market Bulls seemed to sucker the Bears in. As the SPY was fading later morning and our members were saying "Get ready for a fade!" the market internals were telling you something different. Stock heavyweights were not giving up support. AMZN wouldn't relinquish its grip on 547, GS moonshot off the lows, hell, even WMT caught a bid off its 3 year lows. Something was different, and I was letting everyone know "Don't expect the fade at the end of the day."

With the potential for a lack of tightening and possibility of another round of some form of easing, today's tape basically told the bears "Fuck you." The bulls which have been waiting for months for the floor to fall out underneath them decided to take a stand. They decided, for whatever reason, that today would be the day they put the onus on the bears and dare them to move. If you're a bear, this isn't good news.

This is the part of the year where things really start to ramp seasonally. I don't know if it's the cold air, the PSL mania, or all the scarecrows but something about the middle of October on usually gets things going. So with that said, we turned from Heel to Face and sometime around 12pm we went very very long.

GO WITH THE FLOW

I have news for you, the market is in fact rigged. There is no doubt about it, the big boys are in control of it and there is nothing you can do about it. That said, we have advantages that the big boys never have. We have the ability to switch our opinions on a dime and follow the money. Today was a classic example of that. Staying stubborn and not following the trend will blow you out of the water. But days like today are great for us as well because we can participate and stay in the action without risking much capital upfront. We're gonna take a look at some examples of this.

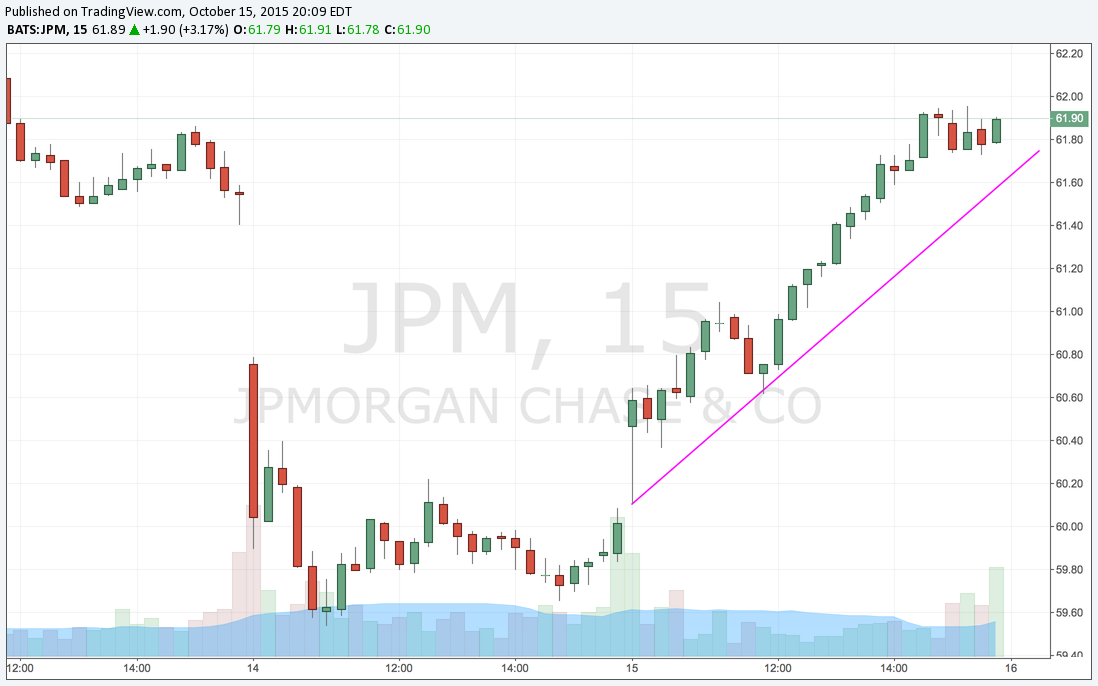

GS & FINANCIALS

This morning I highlighted GS support at 175 for members. We highlighted bias to the downside after an earnings miss and kept it on our radar. GS however decided to change the rhetoric and flipped a long off that 175. That flip along with commentary about growing organic loans from other banks sparked a fire in the space. You could have bought calls very cheaply today and walked away very very pleased if you were paying attention. This is just one example of how simply only knowing the support of a stock could help you capitalize even if your bias was initially incorrect.

GS JPM and XLF

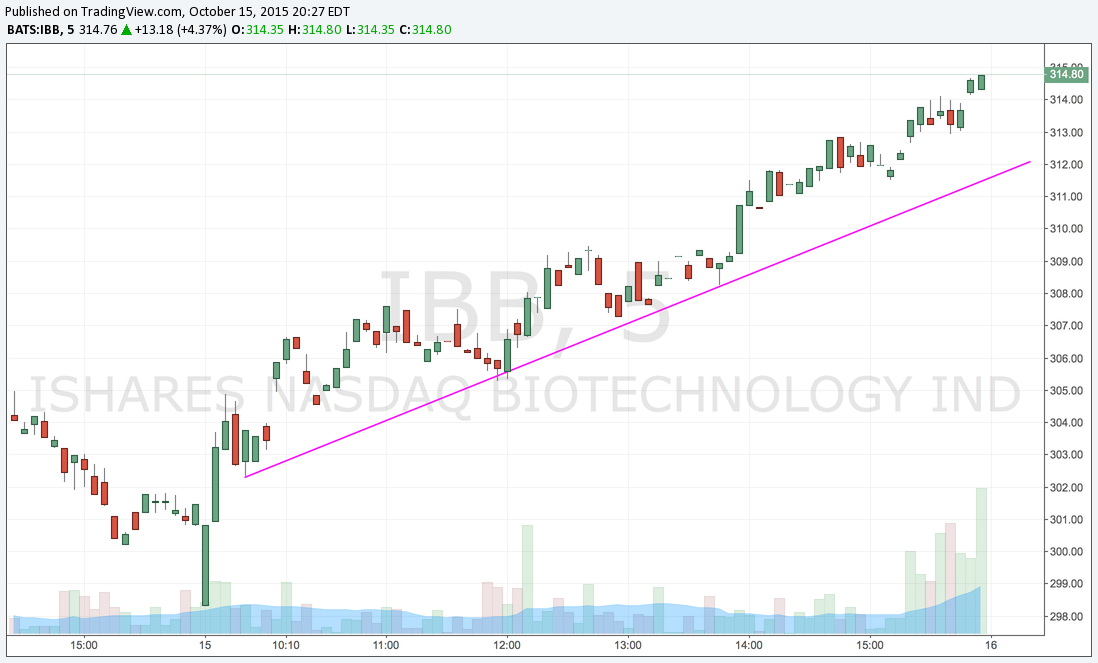

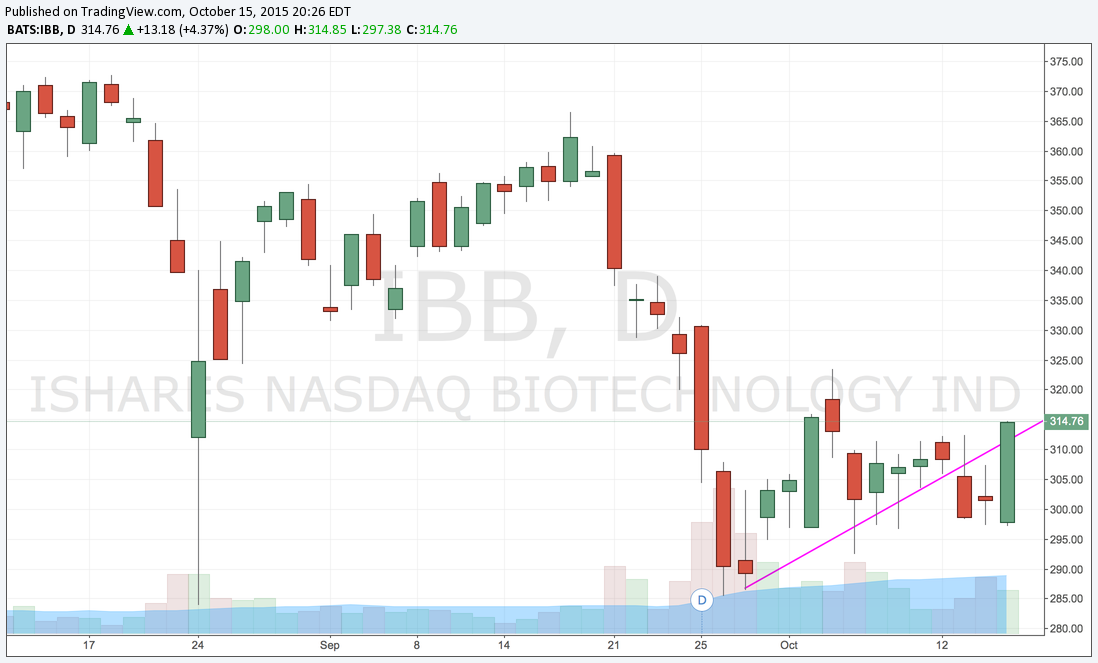

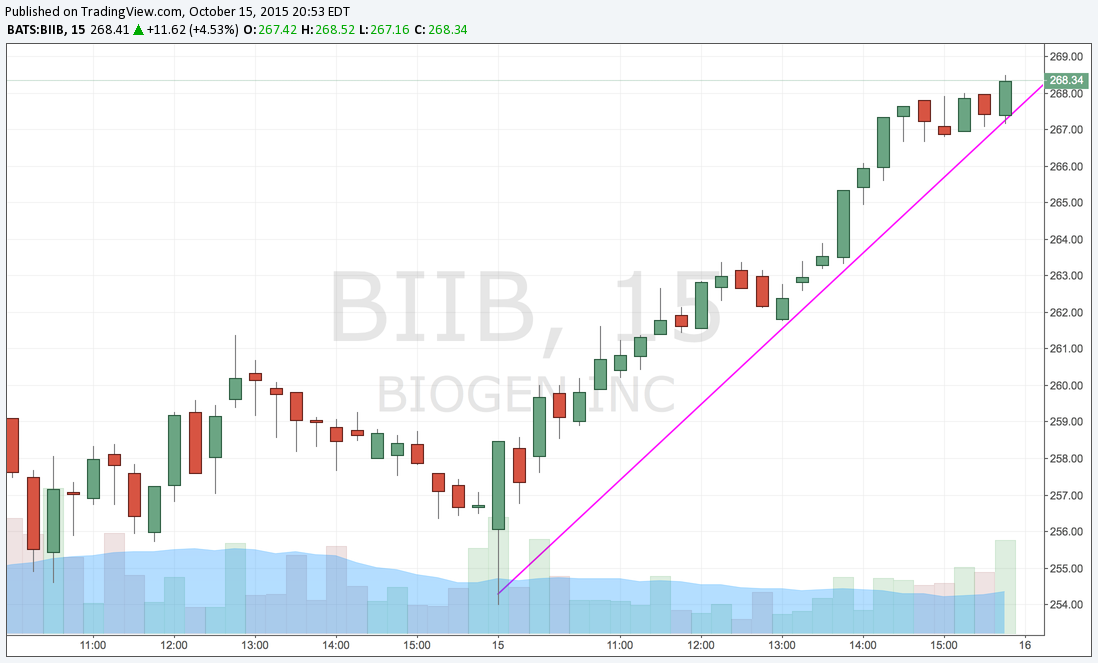

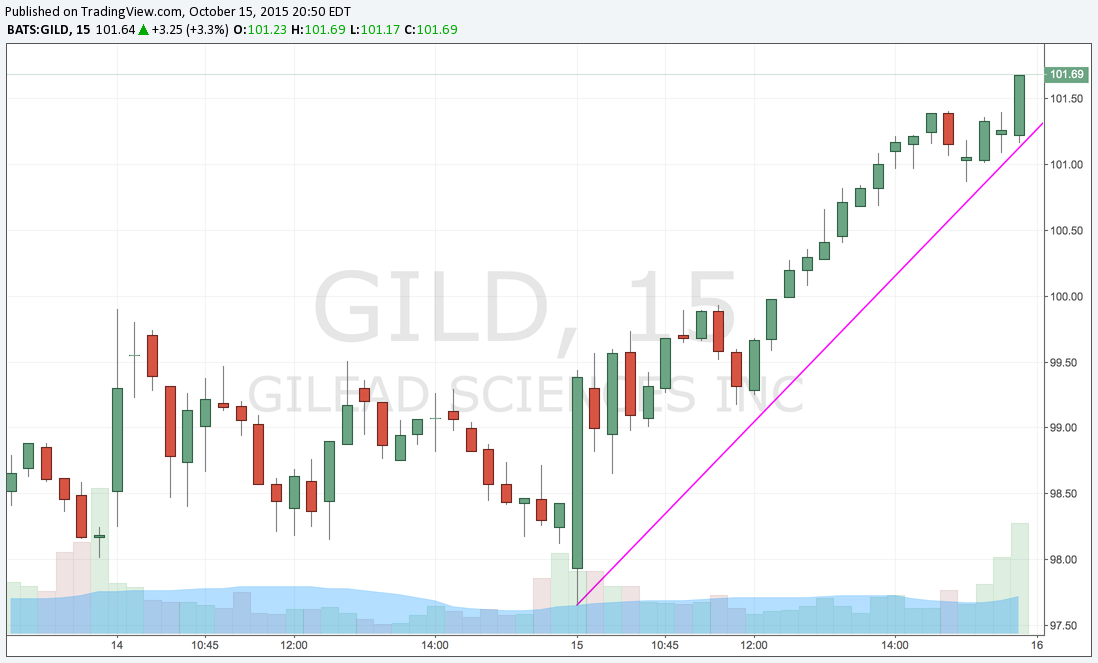

IBB & BIOTECH

In the premarket the IBB looked like it was going to be the leader to the downside. With a subpoena issued to VRX, a heavy market, and with the IBB at support premarket this one appeared as though it was left for dead. Yet again however, buyers stepped in at support. Claiming 298 and riding it higher throughout the day, buyers continued and reclaimed the bear flag breakdown from the other day.

Bios up up and away.

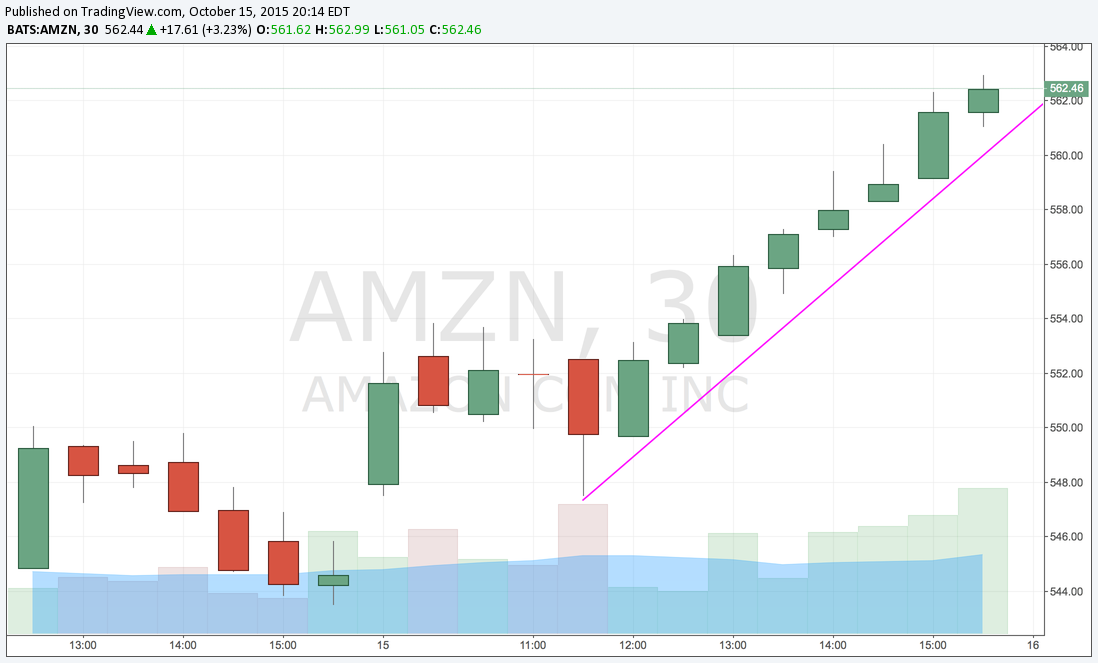

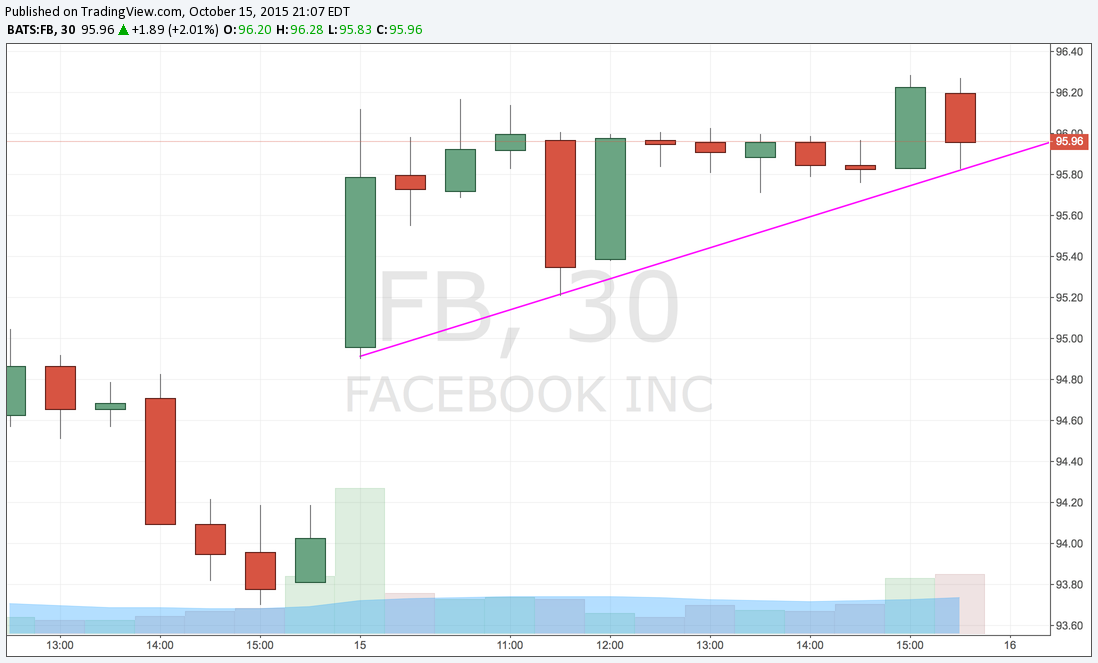

F.N.G. AMZN

With NFLX missing ER last night you would think that the other betas would have been hit as well. That however wasn't the case as the beta cohorts really ramped, especially AMZN.

AMZN gapped higher with the market and appeared it was going to repeat what it went through yesterday where it lagged its internet peers. However, this time AMZN held support at 547 and started its catch up trade higher.

On the heels of poor #'s from NFLX and a bad revision from WMT buyers stepped in ahead of next weeks report and bid the stock to highs not seen since its last ER and its highest closing high ever.

Buying was relentless and lasted throughout the day. Expect this issue to resolve even higher before the company announces next week.

AMZN played "catch up" with its cohorts as it lagged the last couple of days.

SPY & QQQ

This face tearing rally sets us up for an interesting fourth quarter and moving forward. Specifically, the SPX/SPY closed on the highs of the week and appear to have taken out important resistance and setting up for a test of even higher resist.

The same can be said about about the triple Q's which have been the strength of the three indices. Let's take a look at the next levels we may test.

SPY & QQQ Verge of breakout and potential levels.

With the SPY closing above the 202.2 level that was a brick wall of resistance earlier in the week we are primed to test the next levels of support. Barring a cataclysmic fall tomorrow morning look for this market to test the higher highs soon. Remember, we have the flexibility to switch our opinions and positions more often than the big boys. Because of this ability, we can, and should make money going up and going down.