With a recent spark lit in the gaming space by WYNN and their CEO Steve Wynn, Boyd Gaming (BYD) furthered that sentiment today reporting better than expected earnings after the bell today.

Heres a quick summation of how they did:

Boyd Gaming beat by $0.03, reported revs in-line; provided 2016 EBITDA guidance

- Reported Q4 earnings of $0.16 per share, excluding non-recurring items, $0.03 better than the Consensus of $0.13; revenues rose 2.1% year/year to $542.7 mln vs the $541.25 mln Consensus.

- For the full year 2016, the company projects total Adjusted EBITDA, including Peninsula and 50% of Borgata's Adjusted EBITDA, of $635-655 million.

The company issued the following commentary:

The fourth quarter of 2015 was a strong conclusion to a year of solid progress for our Company. Our operating teams continued to drive profitable revenue growth, identify additional efficiencies in our business, and successfully leverage new amenities, all of which contributed to our fifth consecutive quarter of revenue and double-digit Adjusted EBITDA growth. We were particularly encouraged by the performance of our Las Vegas Locals business, as a strengthening economy and effective marketing programs resulted in the segment's strongest fourth-quarter results since 2007. After a strong performance in 2015, we are well-positioned for continued growth and success this year."

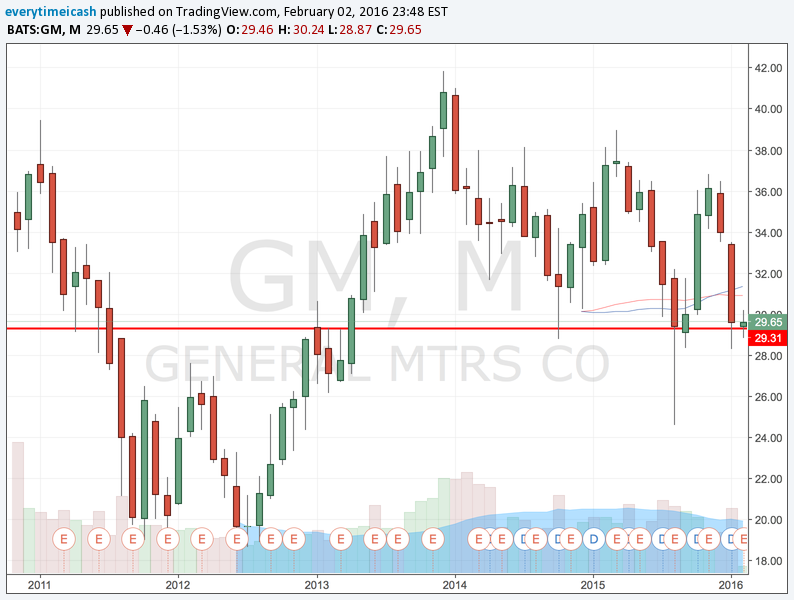

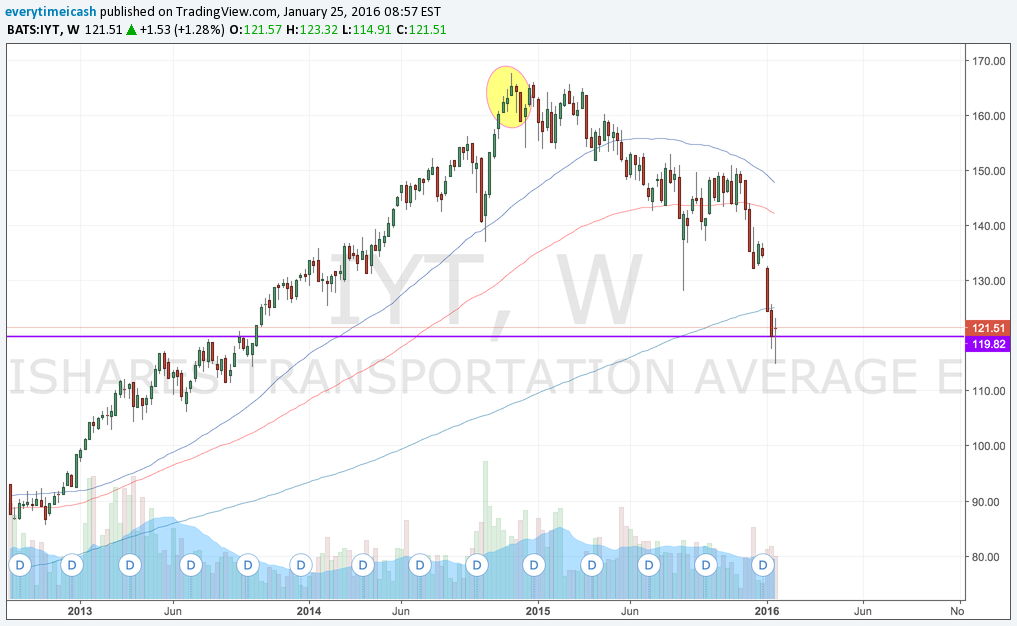

TECH SUPPORT

If BYD opens here tomorrow it will look to make a run for the 9EMA on the Weekly and Daily basis. Above 18 and expect a challenge 20 and potentially a rounded bottom on the monthly.