Consensus calls for EPS of ($0.05) vs ($0.06) last year on revenue of $319.6 mln (+41% YoY)

JD.com (JD) is set to report fourth quarter earnings Tuesday. Current consensus is for the company to report a Q4 loss of CNY 0.12 per share on revenues of CNY 51.69 bln.

Guidance/Key Metrics

Guidance for Q4 revenues of CNY 51.0-52.5 bln (+47-51% Y/Y)

GMV

- GMV is the total value of all orders for products and services placed in their online direct sales business and on their online marketplace, regardless of whether the goods are sold or delivered or returned.

- GMV in Q3 was CNY 115.0 bln, which represented a 71% Y/Y increase. Excluding Paipai.com, which is a C2C service that the company recently discontinued, GMV grew 76% Y/Y. Core GMV from the company's marketplace business grew 121% in Q3 and accounted for nearly 45% of their core GMV during the period. Sequentially, it grew 13% over the seasonally strong Q2.

- Annual active customer accounts

- This metric represents accounts that made at least one purchase during the previous twelve months.

- Annual active customer accounts increased by 59% to 131.9 million in the 12 months ended September 30, 2015 from 82.8 million in the 12 months ended September 30, 2014. Excluding Paipai.com unique customers, annual active customer accounts increased by 62% to 126.9 million in the same period ended September 30, 2015.

- Orders fulfilled

- Orders fulfilled is the total number of orders delivered net of orders returned.

- In Q3 fulfilled orders were 329.7 million, an increase of 85% from 178.2 million for the same period in 2014. Fulfilled orders placed through mobile accounted for approximately 52% of total orders fulfilled in the third quarter of 2015, an increase of more than 210% compared to the same period in 2014.

China Growth

During the Q3 conference call, JD stated that they suspect the macroeconomic headwinds in China may have some impact on their business. They also stated that they still see a very robust growth rate and that the overall consumption rate, at that time, had not been much impacted by the slowing macro environment.

Implied Move

Based on JD options, the current implied volatility stands at ~ 60%, which is 20% lower than historical volatility (over the past 30 days). Based on the JD Weekly Mar04 $26straddle, the options market is currently pricing in a move of ~11% in either direction by weekly expiration (Friday).

Stamps.com $STMP rallied 21% on Friday and was up as much as 25% at one point after reporting an astounding Q4 results and providing bullish guidance for 2016. This quarter exemplified the managements complete turnaround of the company and caught the analysts out of position (rare).

The Biz

Stamps.com is a provider of Internet-based postage services and allows customers to buy and print postage on their computer without having to visit the post office. The company charges a monthly subscription fee plus postage cost. Its platform is also integrated in key partner programs like MS Office and $AMZN marketplace.

Historically the focus has been selling to individuals and small businesses. Recently however, the shift has gone towards more lucrative high volume shippers (warehouses, fulfillment houses/centers, boutiques and high volume retailers) and enterprise markets. This segment shift is more attractive on the margins side, ARPU, and lower churn rates. To get there, $STMP has been active on the M&A front. Its most prominent recent acquisition was buying Endicia from Newell Rubbermaid ($NWL). The deal closed in November 2015. Endicia is a major provider of high volume shipping technologies with seamless access to USPS.

THE QUARTER (Q4)

In Q4 Non-GAAP EPS more than doubled YoY to $1.57, which was well above consensus of $0.95. Revenue rose 67.0% year/year to $69.9 mln, which also was well above consensus of $59.0 mln. $STMP also guided higher for 2016 as they expect non-GAAP EPS of $5.00-5.50 and revenue of $290-310 mln. Both were WELL above consensus with EPS being well above expectations: consensus was $4.33 and $289.7 mln, respectively.

Q4 Mailing and Shipping revenue was $67.2 million, up 67% YoY. In terms of margins, $STMP is highly profitable. Adjusted EBITDA margin for Q4 came in at 43.2% vs 30.5% in the prior year period. This margin expansion was huge and caught the street off guard.

$STMP says it was very pleased with its financial performance. Management says this was another exceptional year for Stamps.com with strong execution on its business goals. This included the integration of its 2014 acquisitions of ShipStation and ShipWorks where $STMP began to realize as it expected from those deals. In late 2015, STMP completed the Endicia acquisition and it has begun working on the process of integrating these businesses.

Record paid customers of 633,000 in Q4 was up 21% YoY and record ARPU, which was $35.35 was up 38% YoY. In addition, total postage printed for Q4 was $1 billion and that was up 71% YoY. For the year as a whole, total postage printed was $2.7 bln, up 52%.

On the call, management described how the business has transformed fairly dramatically over the past few years with a focus on growing its high volume shipping business and with its acquisitions of Endicia, ShipStation and ShipWorks. As a result of those acquisitions, $STMP now has a very wide range of customers and business models. Their shift from one off customers to larger volume shippers is the root of their turnaround.

This increased focus on shipping allows $STMP to expect revenue increases in seasonal periods. In particular, Q4 is expected to be meaningfully higher than the other three quarters due to the seasonally strong Q4 holiday shipping period as STMP saw in 2015. That said, don't expect the same in the 1st quarter of 2016.

Conclusion

$STMP adjusted EBITDA margins, which is a good proxy for cash flow, really sootd out. Q4 came in at 43.2% vs 30.5% in the prior year period. Those are some big margins. Expect that to moderate in Q1 and Q2 as these seasonally slower quarters will not benefit as much from spreading fixed costs over such a large revenue base. But even in the high 30% range is good.

As long as management can maintain this model and fixed costs this should remain a buy. Market permitting.

Splunk (SPLK) is set to report Q4 results tonight after the close with a conference call to follow at 5pm ET. Current Capital IQ consensus stands at EPS of $0.08 on Revenue of $203 mln.

Shares of SPLK have had a difficult start to 2016. SPLK opened up the new year trading at $59 but the stock is down nearly 40%. Valuation has been a key driver of the selling as the stock is trading at a very lofty 162x earnings. Even its sales valuation is frothy as it trades at 8x 2015 sales.

These high valuation, big data names were at the forefront when peer Tableau Software (DATA) reported results on February 4.

One of the primary areas of weakness for DATA was License Revenues so keep an eye on that for SPLK.

One thing that the co has done well in and that is quarterly performance. SPLK has steadily beaten on the top and bottom line and raised its outlook. In fact, Q3 saw an acceleration of revenue growth to 50% compared to 46% in Q2 and it marked its best top line growth in four quarters. The co will need to repeat this performance in order to help offset fears of an industry spend slow down.

SPLK Earnings Trading Activity

- 4Q14 report- Stock rallied from $51 to $69 in the four weeks ahead of earnings before rolling back over and dropping back to $57;

- Q1 report- Stock ran from $66 to $71 ahead of the report and then would see a dip back to $64 in the week that followed;

- Q2 report- Stock bounced from the Aug 24 flush low of $55 back to $66 when it reported four days lower. The stock would be rejected at its 200 sma and eventually slide to $51 on September 29;

- Q3 report- Stock saw a steady grind higher form $54 to $63 ahead of the report. Another beat and raise but yet another round of profit taking following the report...

- Ahead of Q4- A little more unique this time around given the hefty selling. We did see a steady decline ahead of the Q3 report but not to the degree we have seen over the past two months. The stock has rallied approx 20% since February 11.

Key Metrics

- Revenue Growth- Q3 revenue growth was 50%; Q2 was 46%;

- License Revenues- Q3 grew 45% (License revenues was one of the biggest shortfalls in the DATA report); Q2 was 42%.

Guidance

- Q4: Total revenues are expected to be between $200 million and $202 million. Non-GAAP operating margin is expected to be between 5% and 6%.

- FY17: Total revenues are expected to be approximately $850 million.

Q3 Recap

SPLK reported Q3 (Oct) earnings of $0.05 per share, excluding non-recurring items, $0.03 better than the Capital IQ Consensus of $0.02. Revenues rose 50.3% year/year to $174.4 mln vs the $160.31 mln Capital IQ Consensus.

- Co issued upside guidance for Q4, seeing Q4 revs of $200-202 mln vs. $198.27 mln Capital IQ Consensus Estimate. Non-GAAP operating margin is expected to be between 5% and 6%.

- Co raised its guidance for FY16, seeing revs of approx $650 mln (Prior $628-632 mln) vs. $632.52 mln Capital IQ Consensus Estimate. Non-GAAP operating margin is expected to be approximately 3% (was previously between 2% and 3% per prior guidance provided on August 27, 2015).

- Co issued upside guidance for FY17, seeing FY17 revs of approx $850 mln vs. $832.26 mln Capital IQ Consensus Estimate.

Sprouts Farmers Markets (SFM) is scheduled to report 4Q15 earnings before the market opens tomorrow. The company reported last quarter's earnings at 8 AM ET (and a conference call is scheduled at 10 AM ET)

- The Street expects Q4 adj EPS of $0.16 on revs up 24% to $911 mln

- Implied guidance for Q4: adj EPS of $0.15-0.16 on revs of $869-928 mln

- Co beat and raised last earnings. The stock ended the day up ~16% at $23.01. The stock ran an additional 21%, before topping on January 5. On January 6, the co fell 4% on almost 5x daily volume on no news. The co preceded to sell off w/ the rest of the market before finding strong support at $21.25. The stock has recovered some of 2016's losses and is currently trading at the $25.00 level.

Guidance to Look For:

- The Street expects 1Q16 adj EPS of $0.30 on revs up 17% to $1 bln

- The Street expects FY 16 adj EPS of $0.95 on revs up 15% to $4.1 bln

Last Q's Guidance for FY 15

- FY 15 revs guidance remained unchanged at $3.53-3.59 bln.

- Sees FY15 adj EPS of $0.83-0.84 vs Then Capital IQ Consensus of $0.81

- Increased Comps guidance for growth of 5-5.5% (from 4-5% prior guidance)

- Increased guidance for Adj EBITDA growth to 11-13% (from 10-12% prior guidance)

Mid-Term Financial Targets

- ~15%+ net sales

- Mid-single digits comps growth

- 14% unit growth

- 12-16% adj EBITDA growth

- Adj EPS growth of 14-18%

Other Guidance from Last Q

- 2016 real estate Pipeline is on target to help co achieve 14% annual unit growth

- Expect new store productivity in 75-80% range going forward

- Ebitda margin of ~8.3% or 8.2% on 52 week basis

Analyst Commentary:

- On February 12, Stifel initiated coverage w/ a BUY- PT of $27. Stifel stated, "Peer comparison (adjusted for gross profit growth rates) suggests SFM's growth should justify a valuation of 10.8x EV/EBITDA or 22.0x P/E on FY17 estimates. These valuations on our current estimates imply a SFM share price of $26-$27, supporting our $27 target price."

- On January 22, Wells Fargo initiated with a Outperform

- On January 19, Deutsche Bank reiterated Buy rating w/ a $27 PT. DB stated, "we view SFM as the "KR" of the natural/organic space except with growth, given their similar strategies: Invest in price to generate traffic-driven, sustainable MSD comps and, therefore, drive EPS growth through leverage of fixed costs."

Peers: KR, WFM, TFM, WWAV

The current street estimates call for EPS of ($0.15), w/ revs +66% y/y to $678.4 mln.

The current Capital IQ Consensus Estimates call for Q1 EPS of $0.36 on revenues of $12.03 billion

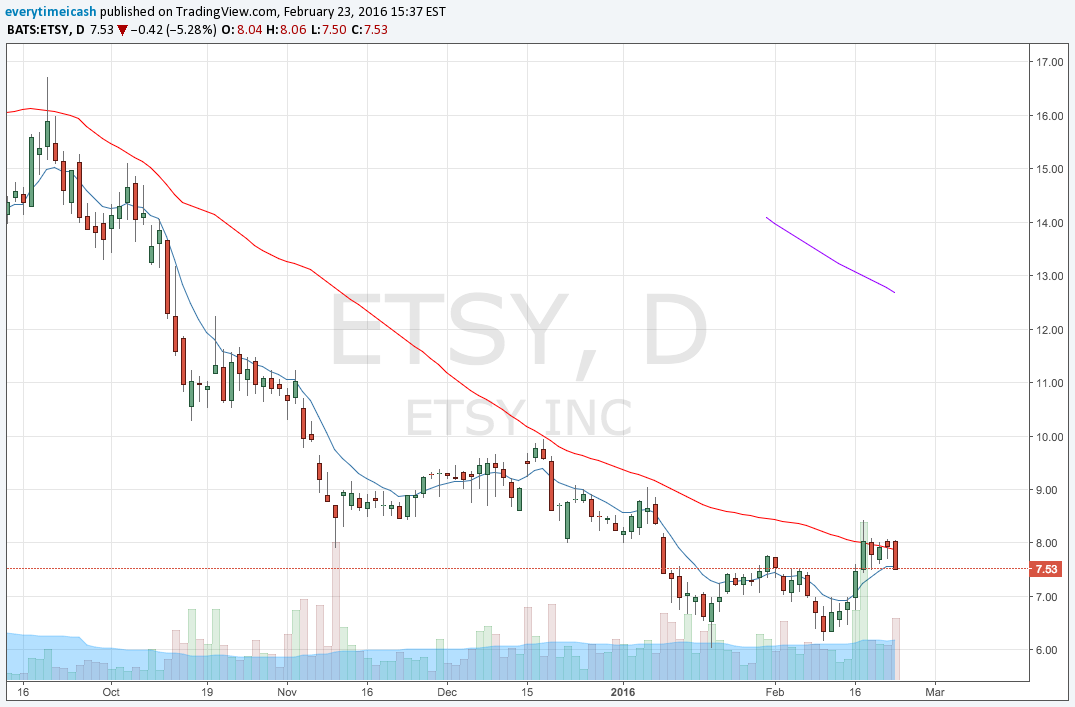

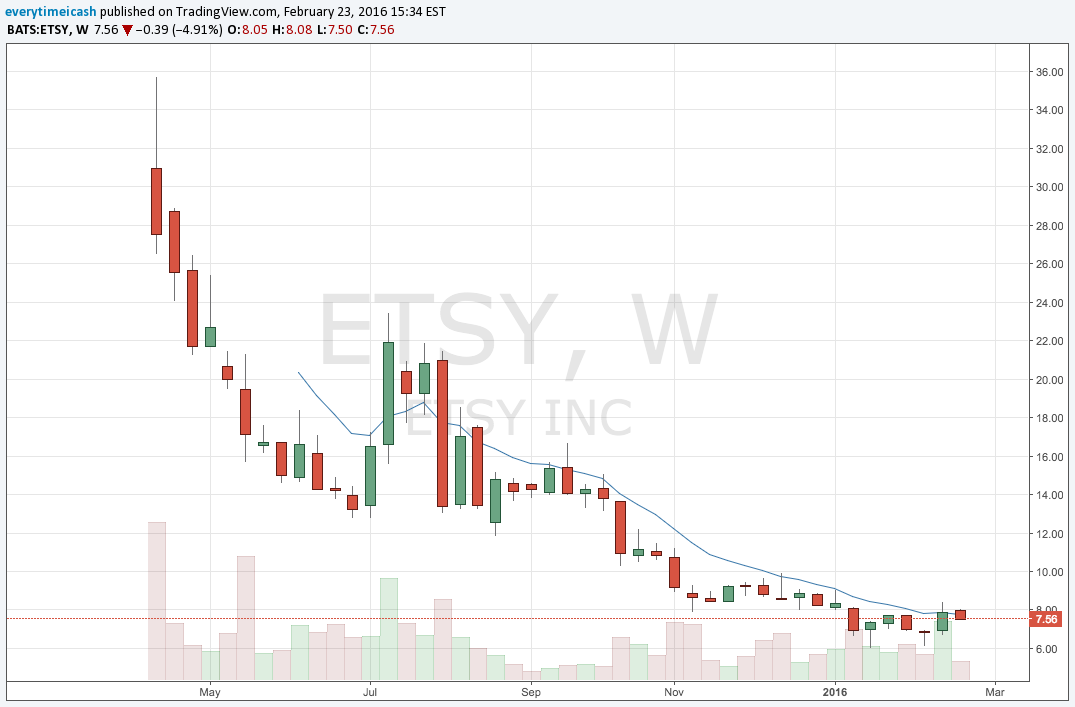

Current street estimates call for GAAP breakeven EPS on revs of $86.64 mln. Etsy's earnings the last two quarters have hit the wires within the first five minutes after the market has closed. In the event ETSY discusses its forward looking guidance, here are the current street expectations for Q1 and FY16

Q1: GAAP EPS of ($0.04), w/ revs +29.4% y/y to $75.74 mln

FY16: GAAP EPS of ($0.10), w/ revs +27.9% y/y to $347.9 mln

After dropping to fresh post-IPO lows just above $6.00 (The IPO priced at $16.00 and opened at $31.00 on 4/16/15) earlier this year, shares have seen some recent interest following the disclosure of new positions taken in Q4 by hedge funds Paulson & Co and Kerrisdale Capital. Still, shares are down 50% from the IPO pricing and 78% from their all-time highs seen its first day of trading. Growth continues to be closely watched amid competition from Amazon and eBay.

Highlights from Last Quarter

Reported Q3 (Sep) loss of $0.06 per share, in-line with the two analyst estimate of ($0.06); revenues rose 38.0% year/year to $65.7 mln vs the $66.39 mln Capital IQ Consensus.

GMS was $568.8 million, up 21.7% compared with the third quarter of 2014. Growth in GMS was driven by 19.4% year-over-year growth in active sellers and 24.9% year-over-year growth in active buyers.

To real time alerts, trades, market insights, and private content.

- Commented on expected performance for Q4:

- "First, from an overall business perspective, we're excited about our competitive position as we head into the fourth quarter - our biggest quarter of the year - and the holiday season. We have launched a holiday campaign that we believe is our strongest holiday effort to date.

- Even so, just as we conveyed in the first and second quarters of 2015, if currency exchange rates remain at current levels, then currency translation will continue to negatively affect reported GMS growth for goods that are not listed in U.S. dollars and will also continue to dampen the demand for U.S. dollar-denominated goods from buyers outside of the United States.

- The second qualitative factor we'd like to highlight is that from a modeling perspective, the operating leverage that we achieved in the third quarter will not repeat in the fourth quarter for a few reasons"

Options Analysis

Based on ETSY options, the current implied volatility stands at ~ 102%, which in 42% higher than the historical volatility (over the past 30 days). Based on the ETSY March $7.5 straddle, the options market is currently pricing in a move of ~21% in either direction by March expiration (March 18th).

Technical Analysis

- Technically the stock has been significantly under-performing since last summer, losing nearly -75% off its July peak of 23.44. The $8-level is currently acting as resistance with its down-sloping 50-day moving average in play. A positive reaction to earnings could put it back on the radar of Buyers if it clears that downtrend, with a potential target at the $10-mark. A negative response to earnings will likely bring its Jan/Feb lows in play as possible support along the $6-level.

With recent institutional adds and with what appears to be a rounding bottom downside risk is limited in this one.

BIAS: BUY

Current position: STO Mar 5 Puts

RESULTS

Etsy misses by $0.04, beats on revs; guides FY16 revs below consensus; sets 2018 targets

- Reports Q4 (Dec) GAAP loss of $0.04 per share, $0.04 worse than the two analyst estimate of ($0.00); revenues rose 35.4% year/year to $87.9 mln vs the $86.64 mln Capital IQ Consensus; GMS +21% to $741.5 mln; adj. EBITDA +51% to $14 mln. Growth in GMS was driven by 15.5% year-over-year growth in active sellers and 21.4% year-over-year growth in active buyers.

- Co issues downside guidance for FY16, sees FY16 revs at high end of (+20-25% YoY) ~$328-342 mln vs. $347.90 mln Capital IQ Consensus Estimate.

What looked like a repeat disaster was uplifted by the following statements made by the company:

"We expect to achieve a three-year revenue CAGR in the 20-25% range and a three-year GMS CAGR in the 13-17% range. In 2016, we expect revenue growth to be at the high end of our three-year range and GMS growth to be near the mid-point of our three-year range... We expect to exit 2018 with a full-year gross margin that is in the mid-60s percent range, and that 2016 gross margin will be in this range as well... Finally, from an Adjusted EBITDA margin perspective, we estimate that our margin in 2016 will be comparable to 2015 in the 10-11% range and that it will expand to the high teens range by the end of 2018."

Current Q4 consensus stands at EPS of $0.77 on Revenue of $928 mln

Earnings results from Target (TGT) will be released tomorrow before the open at ~7am ET followed by conference call at 10:30am ET.

Current consensus estimates are for Q1 EPS of $1.19 on sales -3.2% to $16.6 bln and FY17 EPS $5.16 on sales -2.5% to $72.0 bln.

Full year guidance expected next week as they are hosting Target Financial Community Meeting on March 2).

TGT results follow earnings from big box peer Wal-Mart (WMT) and precedes Costco (COST) - scheduled to report March 2 after the close. ETFs: Retail HOLDRS Trust (RTH) -- TGT ~5%, Consumer Dis Spdr (XLY) 2%, SPDR Retail (XRT) less than 2%.

Key areas of interest:

Q4 results are in-line with previously guided EPS range of $1.48-1.58 (current consensus is $1.54 on sales -0.5% to $21.6 bln).

Guidance: The company will issue Q1 EPS guidance in the earnings press release and comps guidance during the call

Comparable Store Sales

TGT guided for Q4 comps of 1-2% vs +1.5% estimate with digital growth 20%. Q3 comparable sales were +1.9% (near the high end of guidance) and driven primarily by traffic (+1.4% in Q3). Q3 digital sales +20% (well below co's expectation of 30% growth) contributing about 40 bps to comp sales increase. Q3 apparel comp sales grew just under 3% vs nearly 5% in Q2. This slowdown was correlated with warm weather in September. SG&A expenses were solid and in line with expectations. Comps guidance: Co typically discusses any forward looking comps expectations during the conference call.

Margins: Q3 gross margin rate contracted 10 bps to 29.4% (short of co's expectations) and Q3 EBITDA and EBIT margin rates were both ~20 bps higher (consistent with guidance) . Q4 Margin guidance -- gross margin ‘moderate decline' from 28.5% year ago and EBITDA margin rate flat to down slightly from 9.8% last year.

TECHNICAL

BIAS: BULLISH

UPDATE

Target misses by $0.02, reports revs in-line; guides Q1 EPS in-line; guides FY17 EPS above consensus (73.99)

Reports Q4 (Jan) earnings of $1.52 per share, $0.02 worse than the Capital IQ Consensus of $1.54; revenues fell 0.6% year/year to $21.63 bln vs the $21.65 bln Capital IQ Consensus.

Q4 comparable sales increased 1.9 percent vs. +1-2% guidance and 1.5% estimates, driven by traffic growth of 1.3 percent. Digital channel sales increased 34 percent, contributing 1.3 percentage points to comparable sales growth. Fourth quarter comparable sales in signature categories (Style, Baby, Kids and Wellness) grew more than three times faster than the company average.

- Q4 gross margin rate was 27.9 percent, compared with 28.5 percent in 2014, as the benefit from a favorable merchandise mix was more than offset by investments in promotions.

- Co issues in-line guidance for Q1, sees EPS of $1.15-1.25, excluding non-recurring items, vs. $1.19 Capital IQ Consensus Estimate.

- Co issues upside guidance for FY17, sees EPS of $5.20-5.40 vs. $5.16 Capital IQ Consensus Estimate.

Target Earnings Conference Call Highlights

- Guidance: TGT sees Fiscal 2016 comps 1.5-2.5% vs ~2% estimate (Q1 comps slightly lower than this range). Q1 total sales expected to decline excluding pharmacy sales 4.5-5% vs -3.2% estimate. In the guidance, the company said it includes consistent level of buybacks. Full year guidance also assumes some slight margin EBITDA increase.

- Q4 performance played up pretty much in-line as expected -- co knew it was going to be promotional but guests responded favorably to company drivers -- as seen in the traffic. This was the fifth straight quarter of traffic growth and the 1.3% increase was on top of strong 3.8% last year.

- Digital -- co did not quite make its ambitious goal of 40% but it did end the year with 34% growth during Q4

- Merchandise inventory was up 4% - a bit more than the current sales trend. Co said it ended the year with "very clean" inventory position

*DATA SOURCE: BRIEFING*

CHK shares are lower by 56% largely due to the drop in energy prices with Earnings tonight.

The first area of interest will be liquidity and debt

In the co's most recent 10K filing (issued on February 27, 2015) CHK stated "As of December 31, 2014, we had indebtedness of $11.535 bln, and our net indebtedness represented 30% of our total book capitalization, which we define as the sum of total equity and total current and long-term debt less unrestricted cash. Our level of indebtedness affects our operations in several ways...We may continue to incur cash and noncash charges that would negatively impact our future results of operations and liquidity."

Chesapeake currently has no plans to pursue bankruptcy and is aggressively seeking to maximize value for all shareholders.

The next area of interest will be production

Taking a look at last quarter, the company reported that Q3 production averaged ~ 667,000 barrels of oil equivalent, a YoY increase of 3% adjusted for asset sales. Average daily production consisted of ~ 114,100 barrels of oil, 2.9 billion cubic feet of natural gas and 76,200 bbls of NGL, which represent year-over-year increases of 4%, 2% and 7%, respectively; CHK's 2015 third quarter drilling and completion capital expenditures decreased 41% sequentially to ~ $467 million. The company is also expected to guide for FY16 production and capital. The current FY15 guidance for production is for 670 -- 680 mboe per day. FY15 Capital guidance is $3.4-3.9 bln.

Based on the CHK Weekly Feb26 $2.5 straddle, the options market is currently pricing in a move of ~25% in either direction by weekly expiration (Friday).

Technical Perspective

CHK shares have underperformed the Nasdaq so far this year with CHK falling by 15% vs 12% decline in the index.CHK tends to have 5-7% reactions to earnings.

On a positive report, look for resistance near the $3.00 area while support sits near $2.00.

Fitbit beats by $0.10, beats on revs; guides Q1 EPS below consensus, revs below consensus; guides FY16 EPS in-line, revs in-line

FitBit is down after hours after the company's quarterly report. Though their earnings and revenue easily topped Wall Street's forecast the company totally whiffed on forward guidance due to "extra costs" that they will endure in their latest product manufacturing. Below are the highlighted stats from the quarterly report.

- Reports Q4 (Dec) earnings of $0.35 per share, $0.10 better than the Capital IQ Consensus of $0.25; revenues rose 92.2% year/year to $711.6 mln vs the $648 mln Capital IQ Consensus.

- Co sold 8.2 mln connected health and fitness devices.

- U.S. comprised 75% of Q4 revenue; EMEA 12%, APAC 8%, and Other Americas 5%.

- Q4 non-GAAP gross margin adjusted for foreign currency exchange rate impact was 50.0%.

- Active users grew 152% to 16.9 million at year-end 2015 from 6.7 million at year-end 2014

- Co issues downside guidance for Q1, sees EPS of $0.00-$0.02 vs. $0.23 Capital IQ Consensus Estimate; sees Q1 revs of $420-$440 mln vs. $484.59 mln Capital IQ Consensus Estimate. Co states, "For 1Q16, FIT expects several dynamics to drive results. For the first time in the company's history, FIT will make a global launch of new products, Fitbit Blaze and Alta. Launching media campaigns around the world is expected to drive higher sales and marketing expenses for the quarter. Also, the timing of shipments into sales channels may result in the majority of reorders, especially for Alta, coming in the second quarter of 2016. The company also expects to incur additional manufacturing costs in the first quarter to maximize production of new products to meet expected demand, which is expected to impact gross margins in the quarter."

- Co issues in-line guidance for FY16, sees EPS of $1.08-$1.20 vs. $1.14 Capital IQ Consensus Estimate; sees FY16 revs of $2.4-$2.5 bln vs. $2.41 bln Capital IQ Consensus Estimate. Co expects gross margin of 48.5-49.0%.

BIAS: This is dog shit. Sell the "F" out of "it."

Tomorrow before the open, farm equipment giant Deere (DE) is scheduled to report results with analyst expecting EPS of $0.70 on revs of $4.86 bln. If realized, this would mean a YoY decline in EPS of 38% and a decline in revenue of 13.3% YoY.

Last quarter, on Nov 25, Deere reported Q4 earnings of $1.08 per share, $0.34 better than the Consensus of $0.74; net sales (ex-financial services, other rev) fell 26.2% year/year to $5.93 bln vs the $6.11 bln Capital IQ Consensus.

Co also provided a mixed forecast...

Co issues upside guidance for Q1, sees Q1 net sales -11% to ~$4.99 bln vs. $4.92 bln Capital IQ Consensus Estimate. Co issues in-line guidance for FY16, sees FY16 net sales -7% to ~$23.97 bln vs. $24.11 bln Capital IQ Consensus; earnings of $1.4 bln. However, Deere says, "Although our forecast calls for lower results in the year ahead, the outlook represents a level of performance that is considerably better than we have experienced in previous downturns."

Industry Peers and some color on recent earnings reports:

Some of Deere's closest competitors have already reported quarterly results, including AGCO and CNHI, which gives some nice color into the state of the global agriculture business.

On Feb 2, AGCO Corp (AGCO) reported Q4 earnings of $0.80 per share, $0.01 better than the Capital IQ Consensus of $0.79; revenues fell 21.2% year/year to $1.96 bln vs the $2.03 bln Capital IQ Consensus.

Fourth quarter regional sales results: North America (18.9)%, Europe/Africa/Middle East 0.9%, South America (33.9)%, Asia/Pacific (4.5)%. Reports inventory reduction of $134 mln compared to year-end 2014 on a constant currency basis. Co issues guidance for FY16, sees EPS of $2.30 vs. $2.39 Capital IQ Consensus Estimate; sees FY16 revs of approximately $7.0 bln vs. $6.95 bln Capital IQ Consensus Estimate.

AGCO said, "Co states: "Softer industry demand for farm equipment across all regions and the unfavorable effects of foreign currency translation are expected to negatively impact AGCO's sales and earnings for 2016... Gross and operating margins are projected to be below 2015 levels due to the impact of lower sales and production volumes, a weaker sales mix and increased investment in product development expenses. Benefits from the company's cost reduction initiatives are expected to partially offset the volume-related impacts..."

TECH'S

Nordstrom (JWN) is set to report Q4 results today February 18 after the close.

Unlike the other department store names, Nordstrom does not report holiday sales -- and has not updated guidance since last quarter's earnings.

Last quarter, JWN fell to multi-year lows after seeing a slowdown that resulted in the huge Q3 miss and lowered full year outlook. The performance was also below company expectations, which the management said was due to softer sales trends that were generally consistent across channels and merchandise categories. Comparable sales were up only 0.9% (missing estimates for the first time in the past year -- and by nearly more than 200 bps) with Nordstrom Rack comps actually declining 2.2%.

Key points:

- Current Q4 Expectations: Q4 EPS -6% to $1.24 on sales +6% y/y to $4.17 bln and comps +1%.

- Guidance: The earnings release will include FY17/fiscal 2016 outlook (sales given as %)— current estimates are for EPS of $3.56 on sales +6.6% and comps +2.4%. JWN does not typically provide quarterly expectations with its Q4 results.

- Margin related: Reported Q3 gross margin decline of 163 bps to 33.9% primarily due to higher markdowns in addition to the planned impact of higher occupancy costs related to store growth and the increased mix of Nordstrom Rack. Co also lowered its FY16 gross profit rate assumption to 50-60 bps decrease from +/-5 bps prior outlook.

- Other topics of interest:

- Nordstrom Rack will be in focus after the former bright spot turned sour last quarter. Comps specifically were huge disappointment with decline of 2.2% and investors are looking for this segment to bounce back.

- TrunkClub—completed acquisition last August—update likely discussed during the call.

- Expansion plans—as of last qtr the co had 323 stores (118 full-line stores in US/3 in Canada; 194 Nordstrom Racks; 8 ‘other' stores—includes Trunk Club clubhouses, Jeffrey boutiques and Last Chance/clearance stores). Co will likely provide expansion update for FY17 in the earnings release.

- Street expectations: The street and investors alike were shocked by last quarter's results. But even at multi-year lows, some analysts seem to be maintaining cautious stance.

Based on JWN options, the current implied volatility stands at ~ 57%, which in 42% higher than the historical volatility (over the past 30 days). Based on the JWN February $52.5 straddle, the options market is currently pricing in a move of ~11% in either direction by the end of the week.

PCLN is expected to report fourth quarter earnings tomorrow before the open. There is a conference call scheduled for tomorrow morning at 7:30 AM ET.

Consensus calls for EPS of $11.81 (versus $10.85 last year) on revenue of $1.956 billion, up 6% YoY).

The current consensus is within the company's guidance range of $11.10-11.90 & $1.86-1.99 bln. The company is expected to guide for the first quarter where consensus stands at $9.60 & $2.067 billion.

Peers in the space EXPE, CTRP, QUNR, MMYT, TRIP, TZOO, SABR

Gross bookings is the first important metric. Las quarter, the company reported gross travel bookings of $14.8 bln, which was up 7% YoY (or ~22% on a constant currency basis). PCLN's gross profit for the 3rd quarter was $2.9 billion, a 12% increase from the prior year (approximately 29% on a constant currency basis). International operations contributed gross profit in the 3rd quarter of $2.6 billion, an 11% increase versus a year ago (~ 29% on a constant currency basis).

Looking ahead to the fourth quarter, the company is expecting total gross travel bookings to increase ~1-8% (an increase of ~13-20% on a constant currency basis). International gross travel bookings are expected to increase 3-10 in Q4 (or ~17-24% on a constant currency basis).

The next area of interest will be adjusted EBITDA. Adjusted EBITDA for the 3rd quarter 2015 was $1.6 billion, an increase of 12% versus a year ago. Looking ahead to the fourth quarter, the company is expecting adjusted EBITDA of $710-760 mln (versus $712 mln in the same quarter as last year.

Options Activity

- Based on the PCLN February $1080 straddle, the options market is currently pricing in a move of ~13% in either direction by February expiration (Friday).

Technical Perspective

- On a positive report, look for resistance near the $1100-1125 area, while support sits near the $1025-1050 vicinity.

BIAS: BULLISH. LEAVE IT TO THE NEGOTIATOR.

Potbelly Tuesday announced that its fourth quarter ER exploded 76% as they benefitted from high sales and kept their costs low.

Potbelly beats by $0.02, reports revs in-line; guides FY16 EPS above consensus

Reports Q4 (Dec) earnings of $0.08 per share, $0.02 better than the Capital IQ Consensus of $0.06; revenues rose 12.1% year/year to $95.1 mln vs the $94.86 mln Capital IQ Consensus.

Comps +3.7% vs. ests just above 2%.

- Co issues upside guidance for FY16, sees EPS of $0.36-0.38 vs. $0.33 Capital IQ Consensus Estimate. Company-operated comparable store sales growth of ~3.5% to 4.5%; 55 -- 65 total new shop openings, including 45 -- 50 company-operated shop openings; adj. net income up +20%.

For a few months now the street has been asking who is eating Chipotle's lunch (literally and figuratively) well it appears that PotBelly may be seeing an added benefit from the burrito maker's troubles.

The Cheesecake Factory just released their 4th quarter ER results posting an earnings of $0.54 per share and revs of $526.8M.

Cheesecake Factory beats by $0.02, misses on revs

- Reports Q4 (Dec) earnings of $0.54 per share, $0.02 better than the Consensus of $0.52; revenues rose 5.4% year/year to $526.8 mln vs the $532.2 mln Consensus.

- COMPS restaurant sales increased 1.1% in 4Q15.

- The company opened six restaurants during 4Q15, meeting its objective to open as many as 11 Company-owned restaurants domestically in fiscal 2015.

- In fiscal 2016, CAKE continues to expect to open as many as eight company-owned restaurants domestically. Internationally, the company expects as many as four to five restaurants to open under licensing agreements.

- In fiscal 2015, the company repurchased 2.1 mln shares of its common stock at a cost of $104.8 mln, including approximately 350,000 shares repurchased in Q4 at a cost of $17.3 mln.

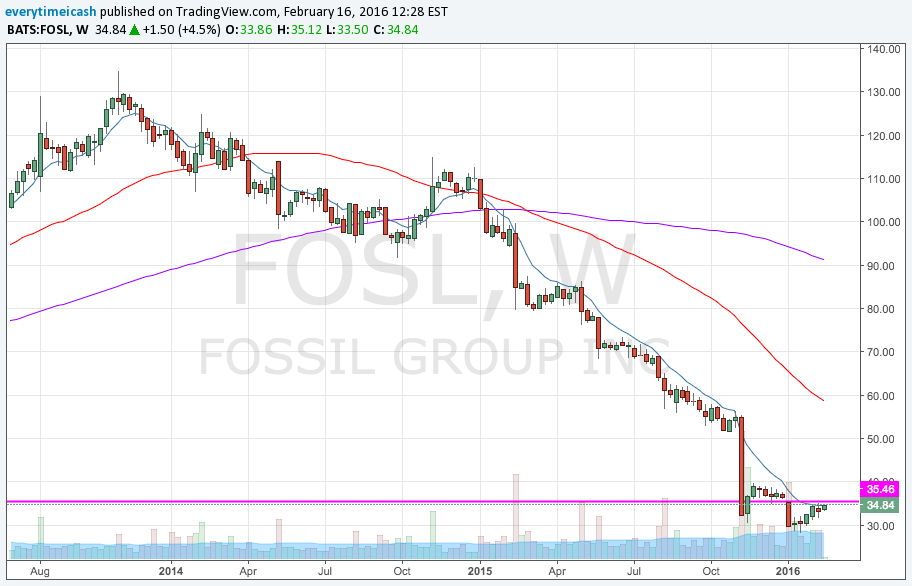

Fossil beats by $0.17, beats on revs; guides Q1 EPS below consensus, revs in-line; guides FY16 EPS in-line, revs above consensus

- Reports Q4 (Dec) GAAP earnings of $1.46 per share, $0.17 better than the Consensus of $1.29; revenues fell 6.8% year/year to $992.5 mln vs the $923.86 mln Consensus. During the fourth quarter of fiscal 2015, the translation impact of a stronger U.S. dollar decreased the Company's reported net sales by $55.6 million, operating income by $38.7 million and diluted earnings per share by $0.28.

- Global retail comps for the fourth quarter of fiscal 2015 increased 1% compared to the fourth quarter of fiscal 2014. A solid comparable sales increase in Europe was partially offset by a modest decline in the Americas and a flat comp in Asia. A comparable sales increase in leathers and watches was partially offset by a decline in jewelry.

- Gross margin decreased 380 basis points to 53.0%.

Co issues guidance for Q1, sees GAAP EPS of $0.05-0.20 vs. $0.41 Capital IQ Consensus Estimate; sees Q1 revs (10)-(7%) to ~$652-674 mln vs. $661.41 mln Capital IQ Consensus Estimate.

Co issues guidance for FY16, sees GAAP EPS of $2.80-3.60 vs. $3.18 Capital IQ Consensus Estimate; sees FY16 revs (3.5%) to +1% ~$3.12-3.26 bln vs. $3.04 bln Capital IQ Consensus Estimate.

This is an example of what happens when expectations are just so low and a company doesnt report nearly as bad as everyone is expecting. Looking at the numbers they aren't that great, but they are a beat. The aspect that is troubling to me however is the continued lowball guidance the company issues.

As you can see from the charts above, not much overhead resistance exists until we meet the MA's at ~50/share

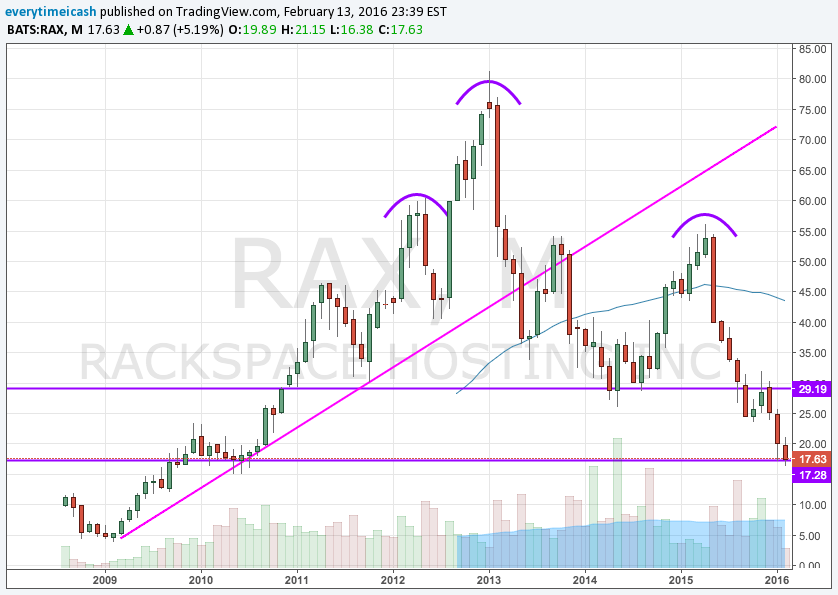

Shares of Rackspace Hosting were off over 8% in the after market session after the cloud-computing company posted lower quarterly earnings yet again. The highlights are as follows:

Rackspace beats by $0.09, reports revs in-line; guides Q1 revs below consensus; guides FY16 revs below consensus

- Reports Q4 (Dec) earnings of $0.31 per share, $0.09 better than the Consensus of $0.22; revenues rose 10.7% year/year to $522.8 mln vs the $521.16 mln Consensus. Adjusted EBITDA for Q4 of 2015 was $184 million, for a margin of 35.1 percent, up 11.0 percent from the fourth quarter of 2014.

Co issues downside guidance for Q1, sees Q1 revs of $517-521 mln vs. $530.08 mln Consensus Estimate.

Co issues downside guidance for FY16, sees FY16 revs of $2.08-2.16 bln vs. $2.21 bln Consensus Estimate.

Guidance Details: Excluding the expected negative impact of currency movements and a small divestiture, we expect our normalized year-over-year growth rate for the quarter to range between 9.2 percent and 10.2 percent.... Excluding the expected negative impact of currency movements and a small divestiture, we expect our normalized growth rate for the year to range between 6 percent and 10 percent. Adjusted EBITDA margins are expected to range between 33 percent and 35 percent for the first quarter and the full year.

There is no solace in any of these charts.

ISSUES

This company started seeing issues last year as AWS started beefing up its cloud business. Last May management blamed its struggles on currency rates and one time costs, but as we've learned in the last 10 months these issues are systemic.

With guidance cut yet again there really hasn't been much hope for the stock and that appears to continue as the stock's off 8% in the aftermarket.

This theme is what we expected before earnings today. As described in the earnings packet.

BIAS: GET THE FUCK OUT.