Tesla will report Q1 results after the bell in a letter to shareholders on its website; conference call starts at 16:30.

The Street is expecting Q1 non-GAAP EPS of ($0.68) vs. ($0.36) last year with non-GAAP rev +45% to $1.6 bln.

Tesla pre-announced Q1 deliveries below guidance due to supply/production issues with the Model X.

Guidance:

- Because production is now on plan and Q1 orders exceeded Q1 deliveries by a wide margin, with Q1 Model S orders being 45% higher than Q1 last year, Tesla reaffirmed its full-year delivery guidance of 80-90K vehicles. By year-end, Model S gross margin should begin to approach 30% and Model X gross margin should be about 25%, with continued improvement for Model X in 2017. Tesla also guided for op-ex up 20% YoY.

- Tesla may have to raise capital sometime this year given its cash burn. Model 3 deliveries are targeted for late 2017 but they won't start in earnest until 2018. Musk has said Tesla learned from its mistakes in missing Model S and Model X production targets.

TODAY:

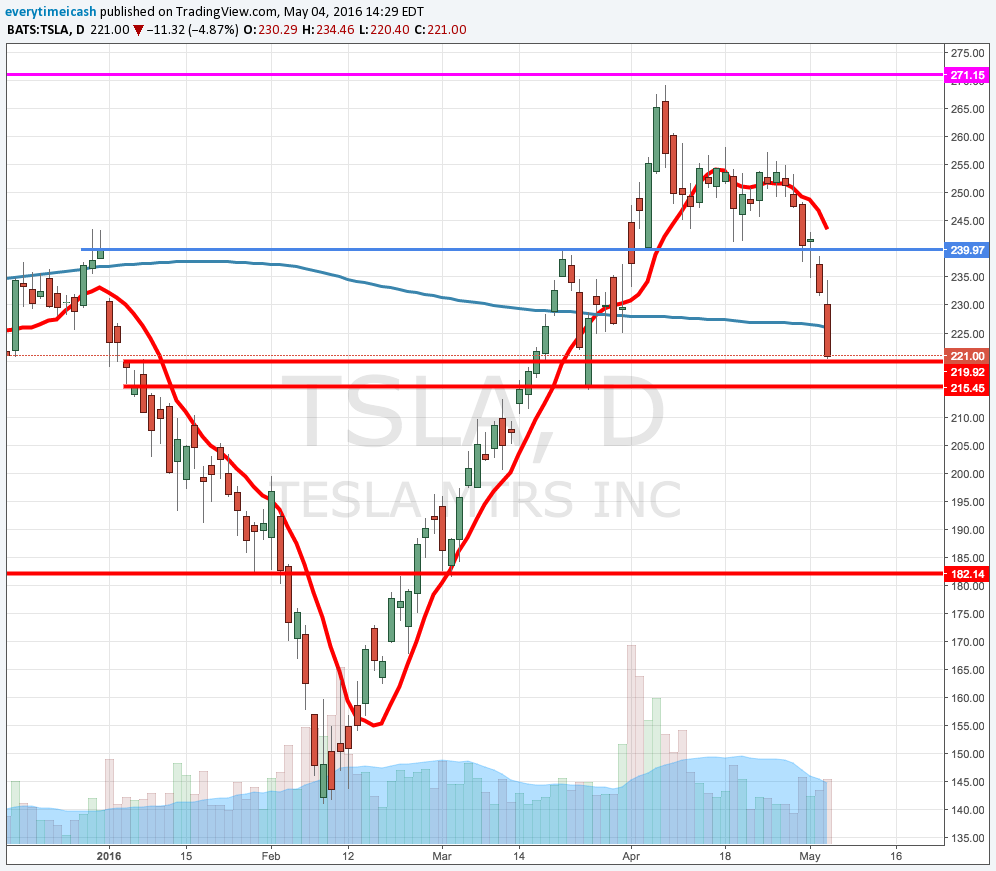

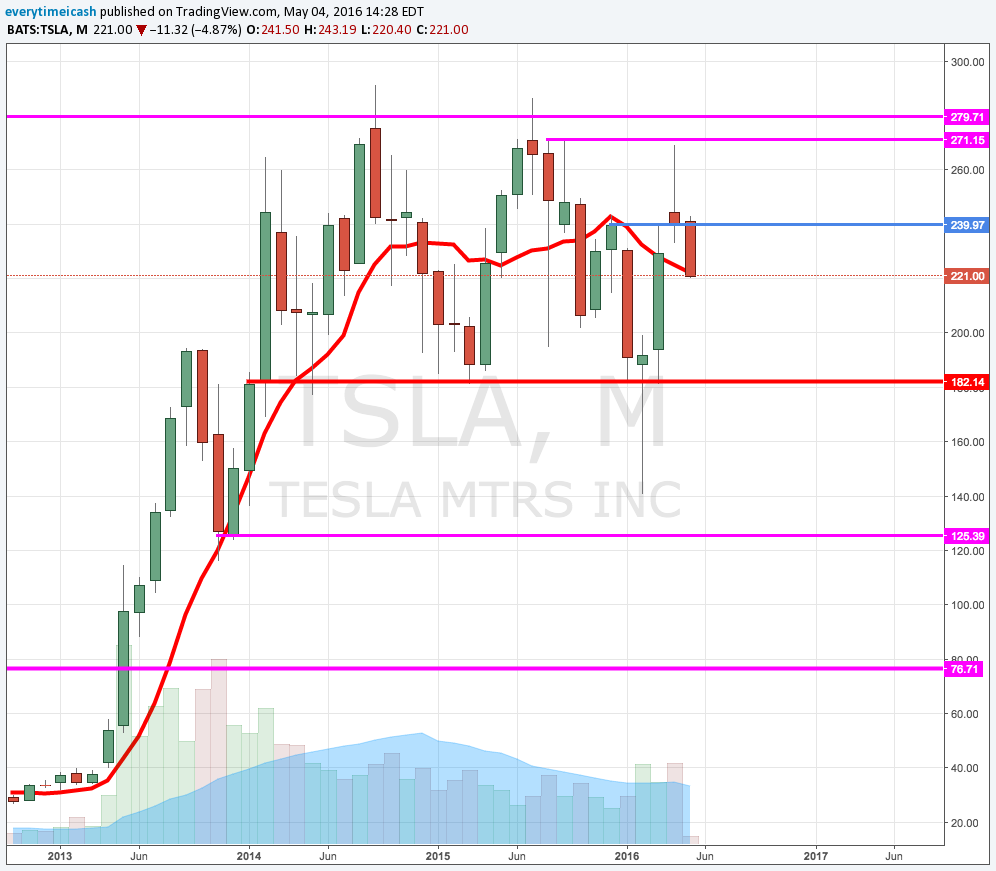

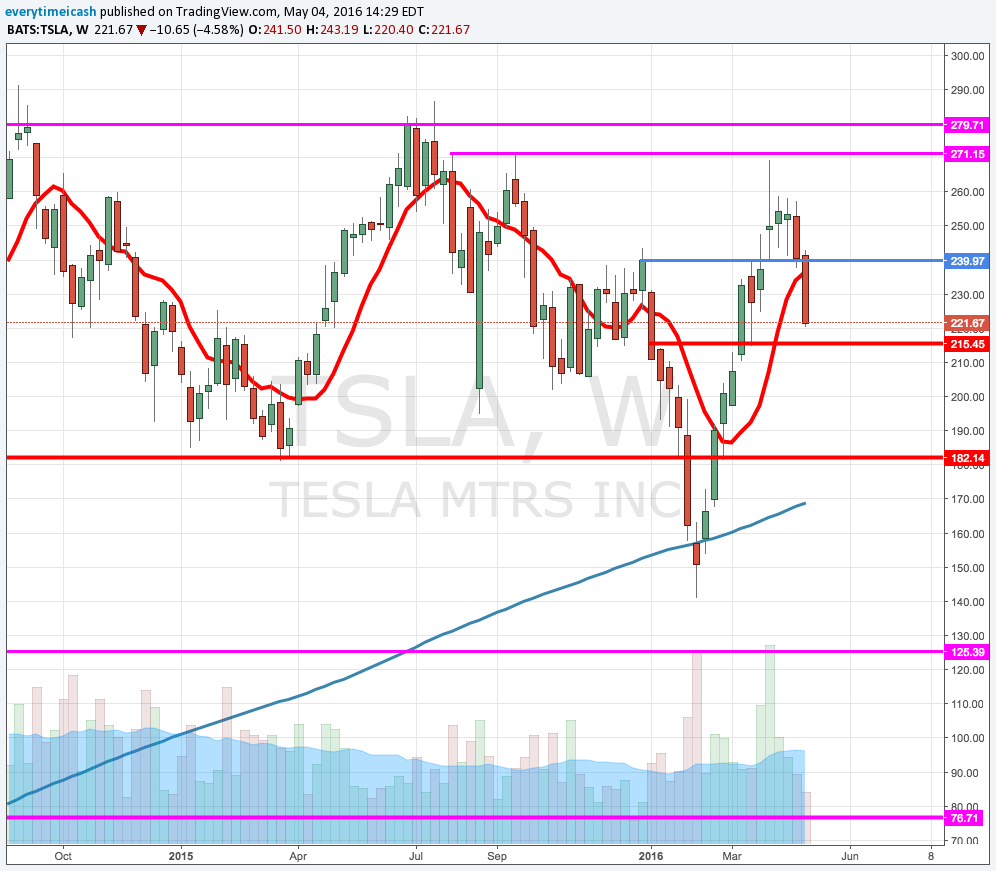

TSLA fell back below the critical 240 level in the market's recent pullback. Shares have come under pressure today following reports that two VPs of manufacturing are leaving the company.

Shares are trading lower by $10.15 at $222.17 in Wednesday's session. The double whammy of hedge fund manager Jim Chanos and high level exiting the company has longs extremely nervous about its Q1 report due out after the close.

RESULTS:

- Reports Q1 (Mar) loss of $0.57 per share, excluding non-recurring items, $0.10 better than the Capital IQ Consensus of ($0.67); revenues rose 45.1% year/year to $1.6 bln vs the $1.6 bln Capital IQ Consensus.

- Preannounced Q1 deliveries of 14,820, below 16K guidance and Model S orders +45% on April 5th.

- In Q2, we expect to produce about 20,000 vehicles, representing a sequential increase of nearly 30%, and will deliver as many of these cars as we can in Q2, with the rest being delivered in Q3. Due to a large number of vehicles in transit to customers in Europe and Asia at end of quarter, Q2 deliveries are expected to be ~17,000 vehicles. Importantly, now that supply chain constraints have been resolved, we plan to exit Q2 at a steady production rate of 2,000 vehicles per week, thus laying the foundation for a strong Q3 delivery number.

- Looking out beyond Q2, we remain confident that we can deliver 80,000 to 90,000 new Model S and Model X vehicles in 2016. This is due to the growing demand we are seeing for Model S and Model X, the improved rate of production that we project for Q2, and the production increases planned for the back half of 2016. Model S cost reductions and improving Model X manufacturing efficiency should cause Automotive gross margin to increase. We are on plan for Model S non-GAAP gross margin to approach 30% and Model X non-GAAP gross margin of about 25% by year-end, with higher Model X gross margin in 2017.

- Given the demand for Model 3, we have decided to advance our 500,000 total unit build plan (combined for Model S, Model X, and Model 3) to 2018, two years earlier than previously planned. Increasing production five fold over the next two years will be challenging and will likely require some additional capital, but this is our goal and we will be working hard to achieve it. We remain on plan to make the first cells at the Gigafactory in Q4 2016, and we are adjusting our plans there to accommodate our revised build plan.

- Given our plans to advance our 500,000 total unit build plan, essentially doubling the prior growth plan, we are re-evaluating our level of capital expenditures, but expect it will be about 50% higher than our previous guidance of $1.5 billion for 2016. Naturally, this will impact our ability to be net cash flow positive for the year, but given the demand for Model 3, investing to meet that demand is the best long-term decision for Tesla. Non-GAAP operating expenses should increase by about 20- 25%, up from +20%.

Tesla Motors (TSLA) reported largely in-line Q1 results last night after the company preannounced Q1 deliveries below guidance last month due to Model X production issues. More importantly, Tesla announced very aggressive production targets that seemingly make a capital raise inevitable.

Encouragingly, production has picked up and demand for the Model S accelerated in Q1, with orders up 45% year over year.

Tesla now plans to build 500K vehicles (Model S, X and 3) in 2018, two years earlier than previously planned. Tesla is planning to build 100-200K Model 3s in the second half of 2017. Elon Musk said there is a high probability you will receive your Model 3 in 2018 if you place a reservation right now. Before last night's news, analysts may have assumed a new reservation wouldn't land you a Model 3 until 2019.

Notably, many were skeptical that Tesla could hit the 500K target in 2020.

As a result, Tesla raised operating expense (to 20-25% growth from +20%) and capital expenditure guidance (~50% from $1.5 billion previously) and backed off its non-GAAP profitability and positive free cash flow targets for 2016.

Both the Bulls and Bears have something to chew on by this news. Bears will say it's an unrealistic product target that will require an excessively dilutive capital raise. But TSLA bulls have faith in their ambitious CEO. Successful execution will put the company even further ahead of the incumbent auto makers in the electric vehicle market and even the tech giants like Apple and Google planning an entrance in the auto market.

Tesla is now even more so a story of manufacturing execution. Much faith is required in Elon Musk, especially at this $28 billion valuation.

Tesla shares are 5% lower today after Elon Musk raised the stakes yet again and signaled an inevitable capital raise.